[2023 updated] NYU Student Insurance Waiver Guide

NYU Fall 2023 Deadline to Waive

September 30,2023 11:59:59 pm EST

“ Simply submit your waiver with us,

save up to $3,484 a year from your insurance cost! ”

Navigation:

- What is an Insurance Waiver?

- Why are Alternative Health Insurance Plans More Affordable?

- How to Pick a Health Insurance Plan?

- Student Medicover Insurance Plan vs. NYU Insurance Plan

- Limited Time Summer Campaign – The More You Refer The More You Get!

- How do NYU Students Stay Covered with Student Medicover?

- How to Enroll and Waive?

Navigation

1. What is an Insurance Waiver?

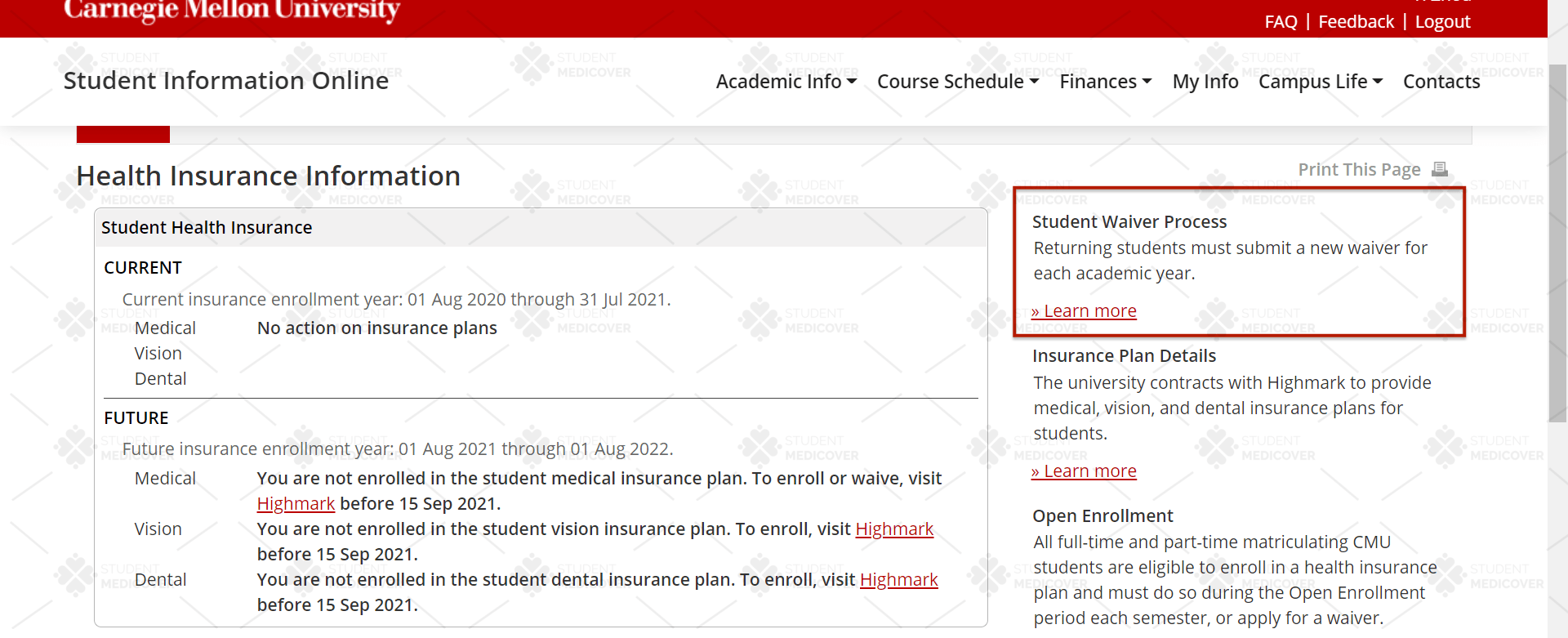

The university requires all international students to enroll in medical insurance while studying abroad in the United States. On your NYU student account, you will see that New York University has automatically enrolled you in the university’s Student Health Insurance Plan.

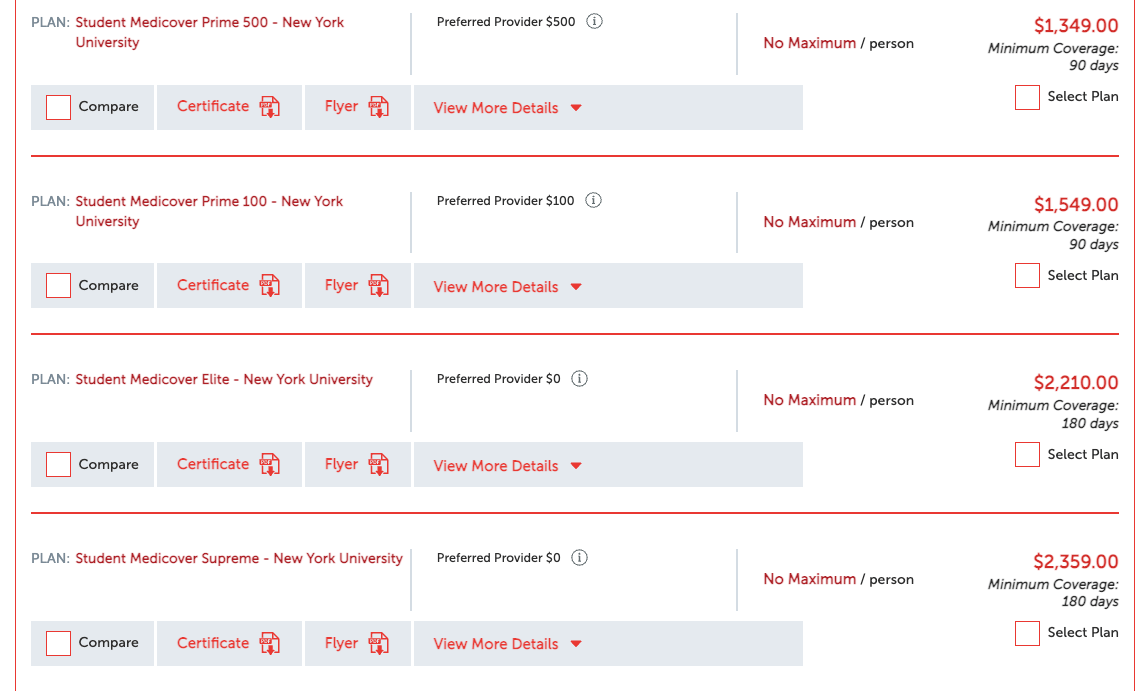

However, international students can enroll in a surprisingly more affordable plan designed specifically for them. This year, NYU’s insurance plan costs up to $4,832 a year. Alternatively, health coverage for international students can be as low as $1,349 a year.

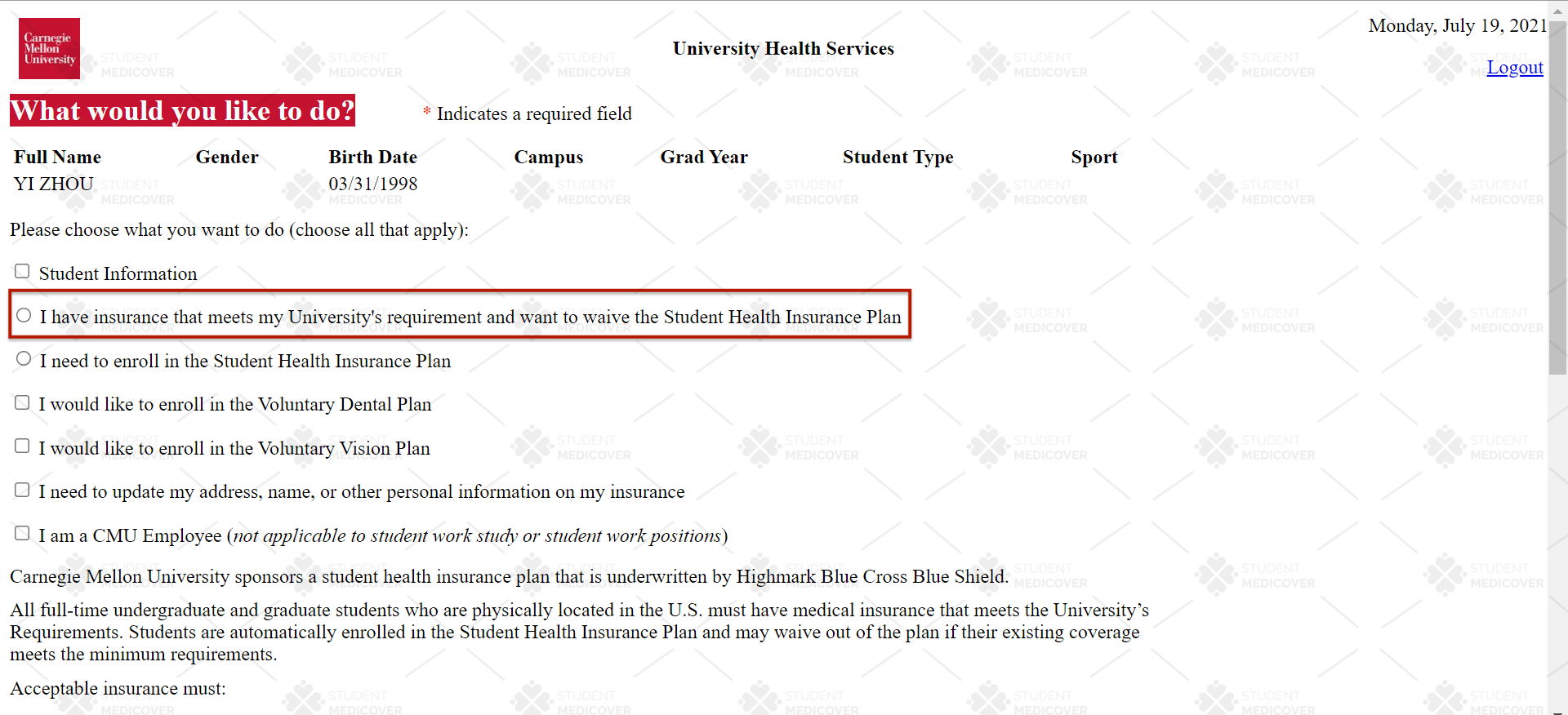

An insurance waiver is an application to switch your plan that better fits your needs. Enroll in an insurance plan that meets the school’s waiver requirements and submit an insurance waiver on the school’s website. For school-specific waiver regulations, please refer to your school’s website.

2. Why are Alternative Health Insurance Plans More Affordable?

The insurance costs are calculated based on the risk factors, demographic factors are essential to the health insurance cost. Health insurance plans offered by universities or colleges are usually more expensive because the plans serve a broader range of the population, including international and domestic students.

Student Medicover provides medical insurance specifically for international F1 students and J1 Scholars. While offering quality health insurance, Student Medicover insurance plans can often save students $1,000-$3,000 per year, with comparable or better benefits.

3. How to Pick a Health Insurance Plan?

A good insurance plan protects you from minor illnesses to serious injuries and diseases. When you’re looking for a plan, consider these factors:

- The Cost

Some plans are much more cost-effective than others. But the cost is the only factor you need to take into consideration. A plan with limited coverage can lead to catastrophic financial loss.

- Insurance benefits

Read the insurance policies carefully. A good insurance plan should have a low deductible, high coinsurance, low copays, and a low out-of-pocket maximum.

- Provider network

The Provider network is a group of care providers partnering with the insurance company to provide you with pre-negotiated rates. A powerful network allows you to find trustworthy doctors and hospitals wherever you need them.

Overall, it’s important to carefully compare the coverage and benefits of any health insurance plan before making a decision, as lower costs may come with trade-offs in terms of coverage or access to care.

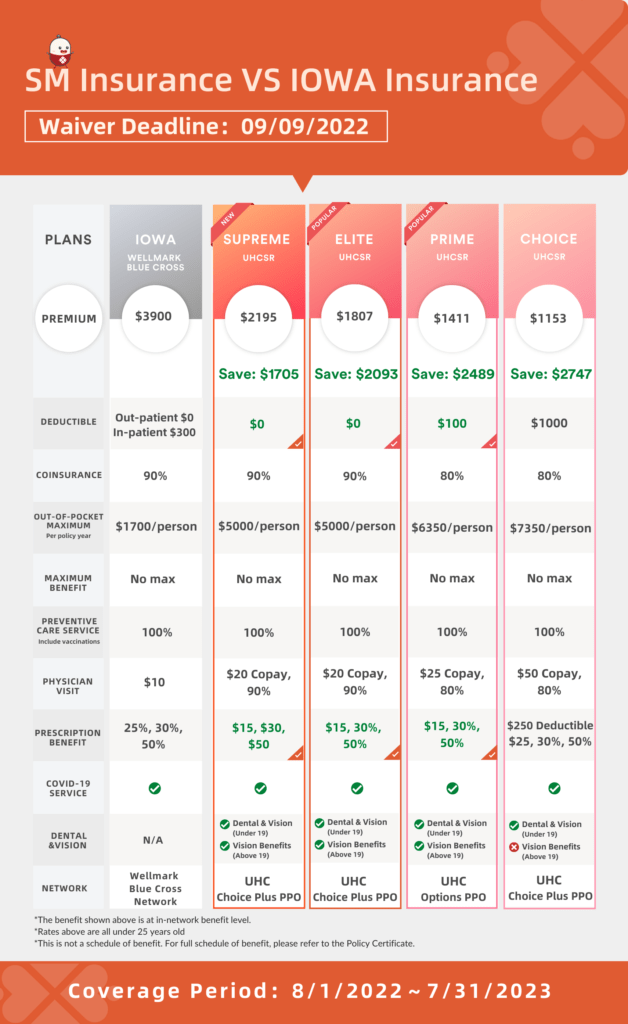

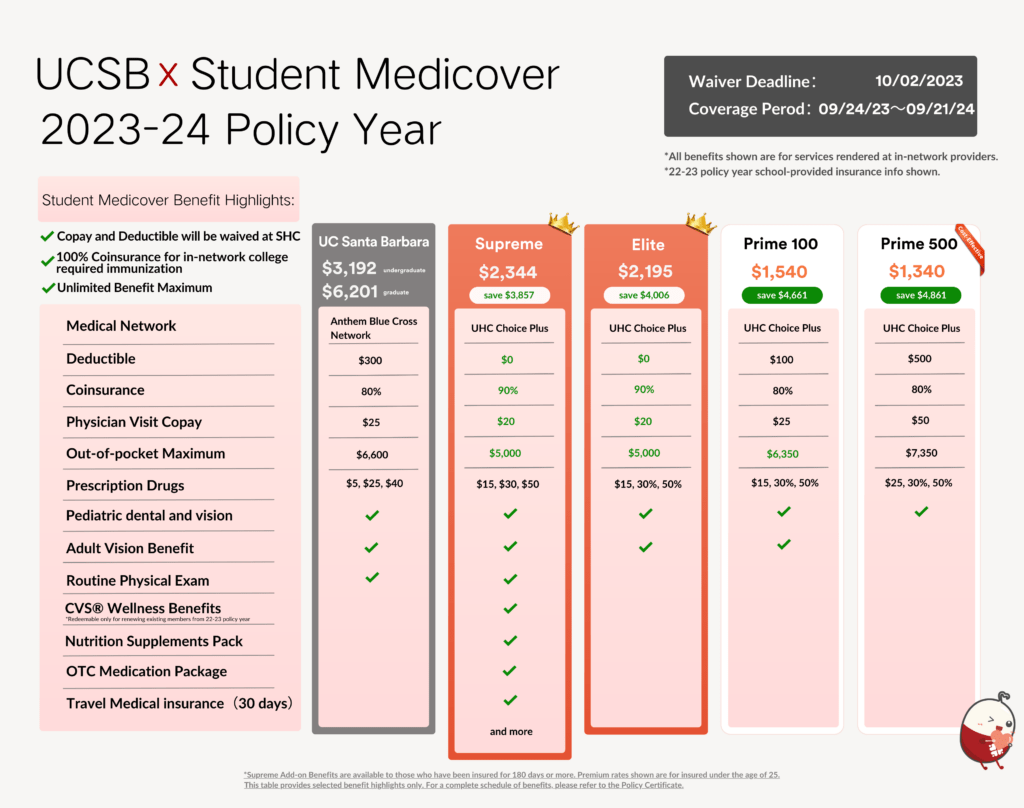

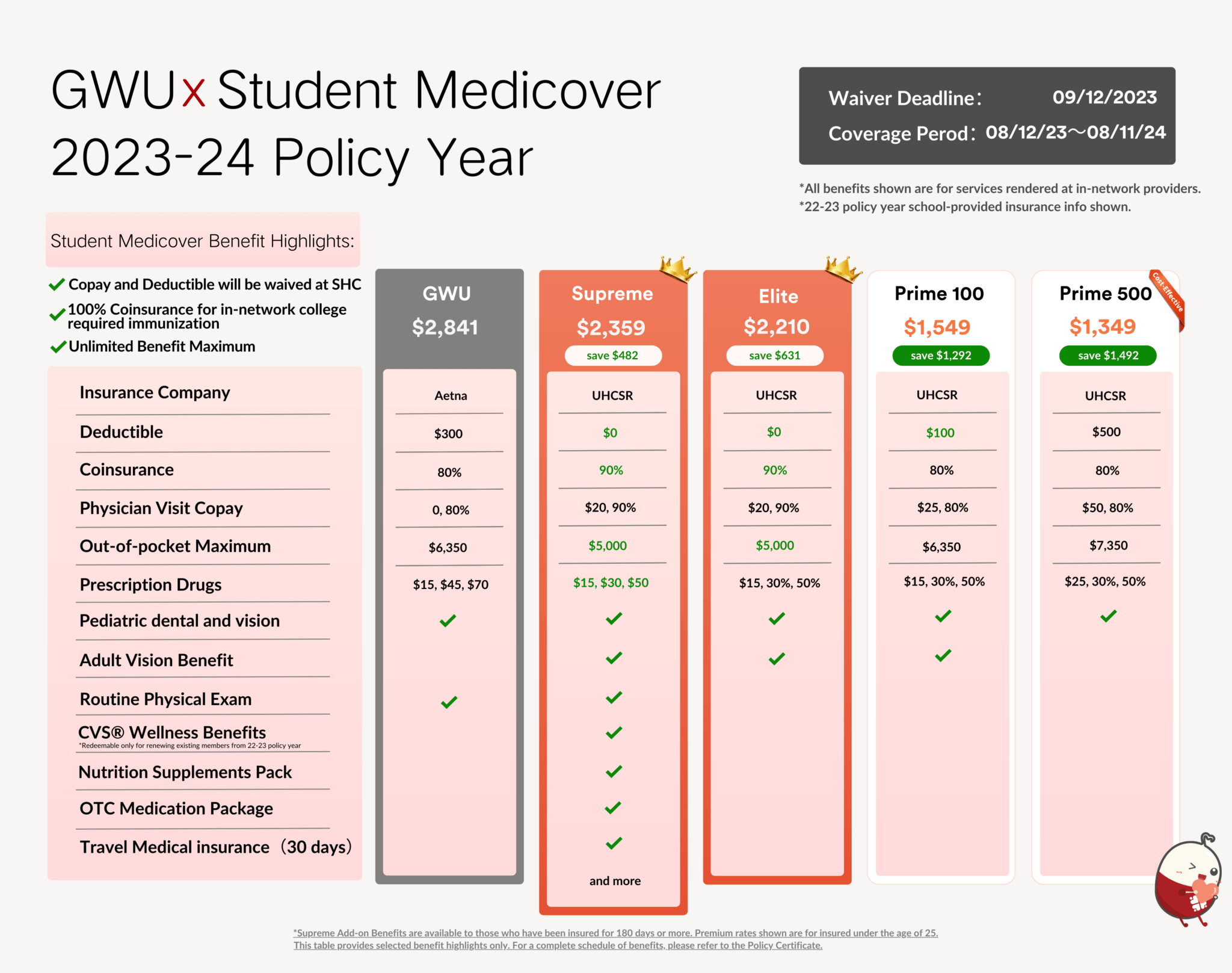

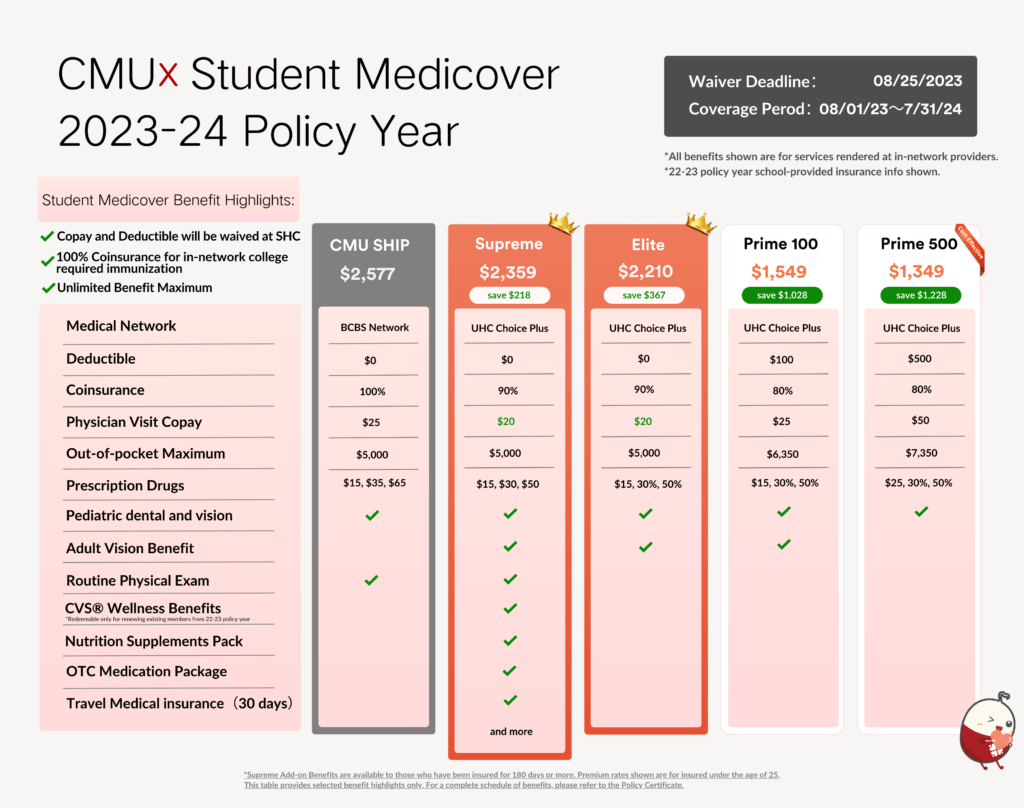

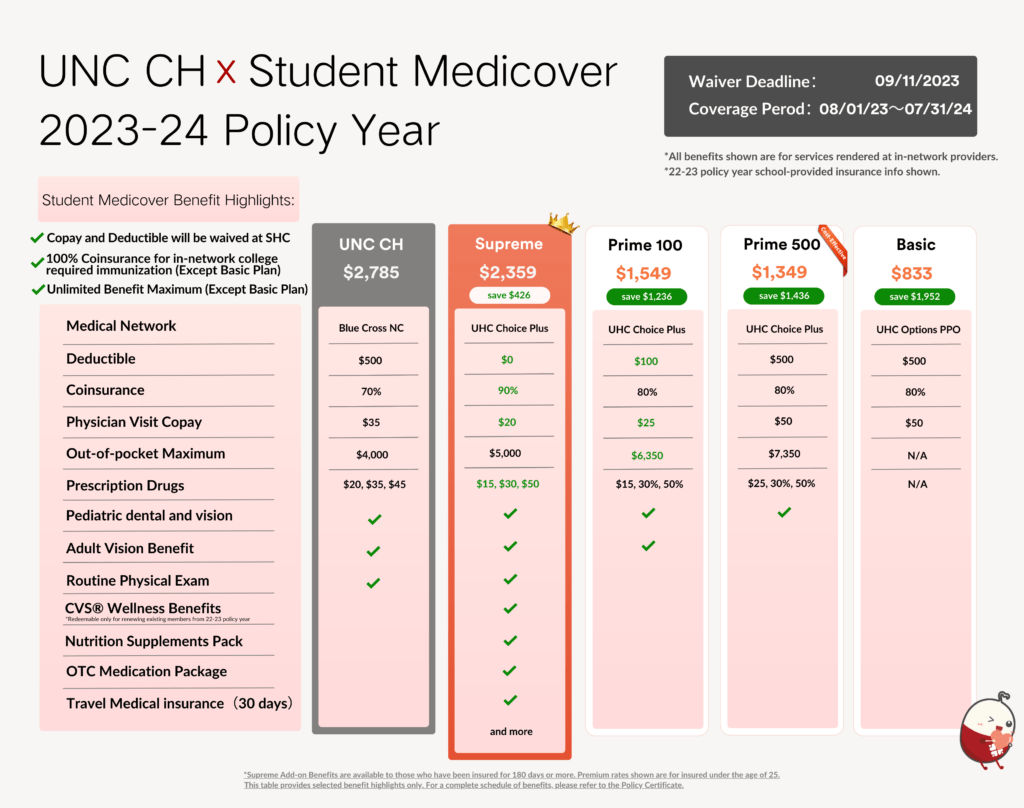

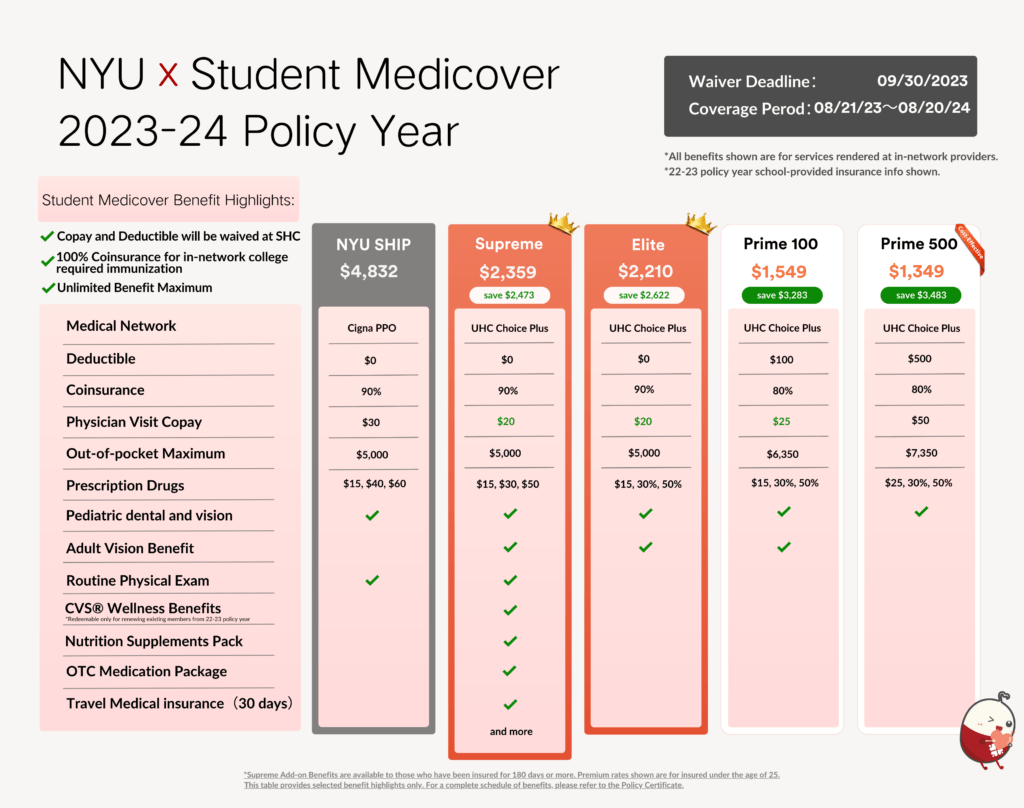

4. Student Medicover Insurance Plans vs. NYU-sponsored Student Health Insurance Plan

By waiving NYU-sponsored Student Health Insurance with Student Medicover you can save up to $3,484!

Note: the premium rates shown are for insureds under the age of 25, please contact us for the premium rates or plan options for other age groups.

6. How do NYU Students Stay Covered with Student Medicover?

SM Elite Users Insurance Claims Cases

Other Student Medicover Insureds Testmonials

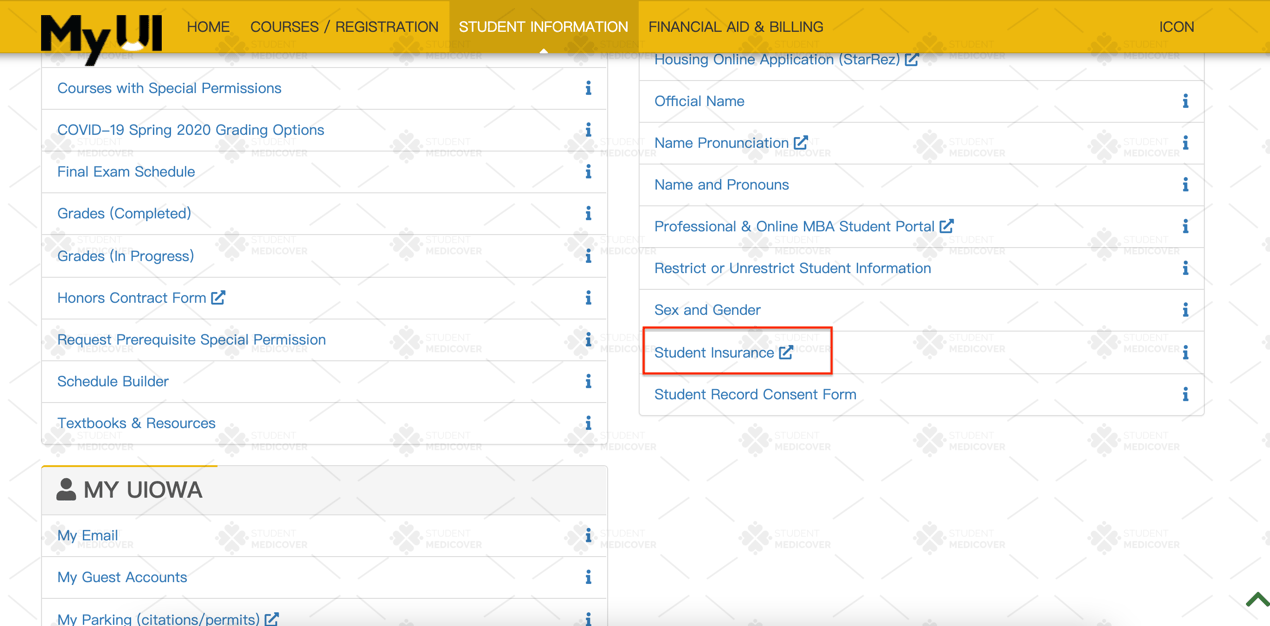

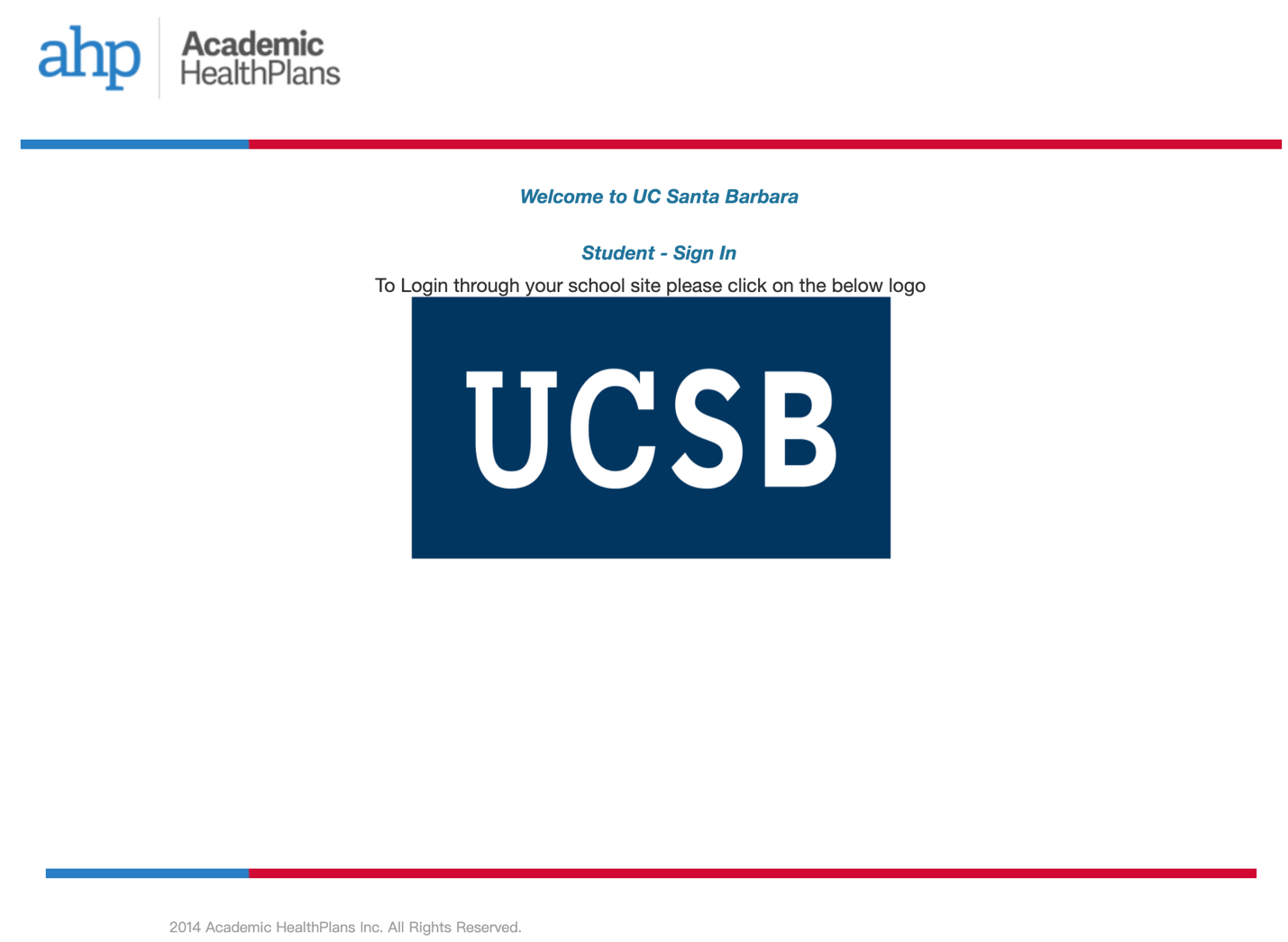

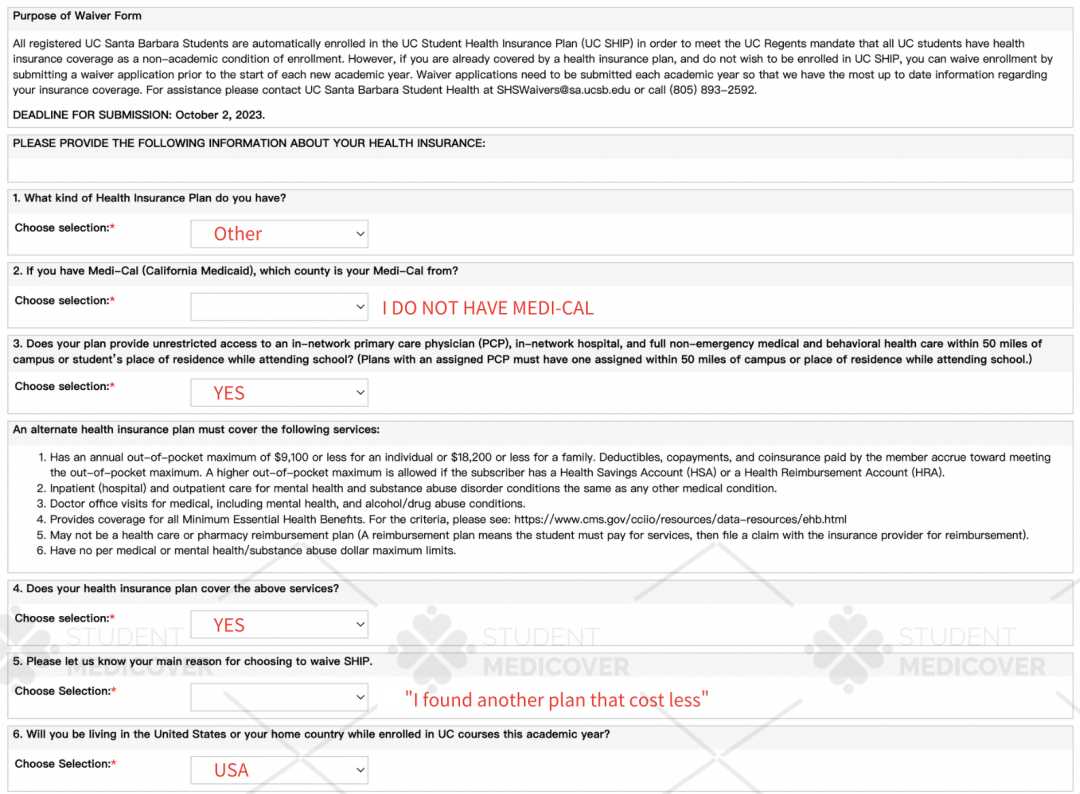

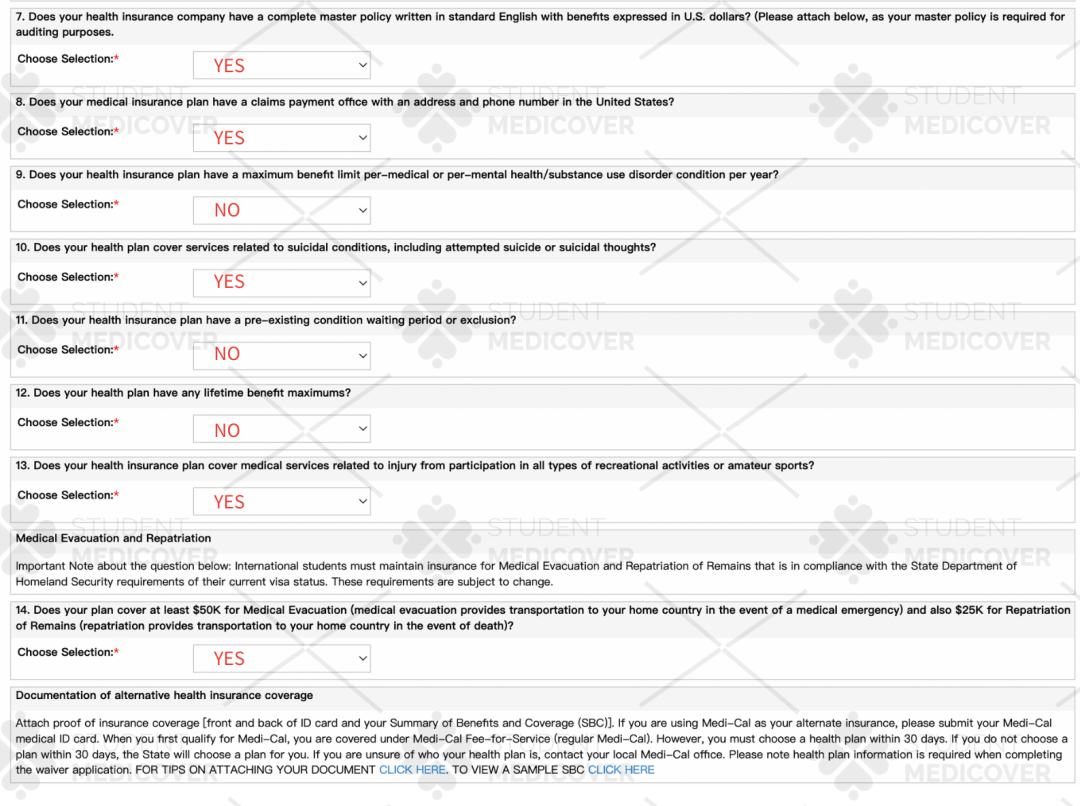

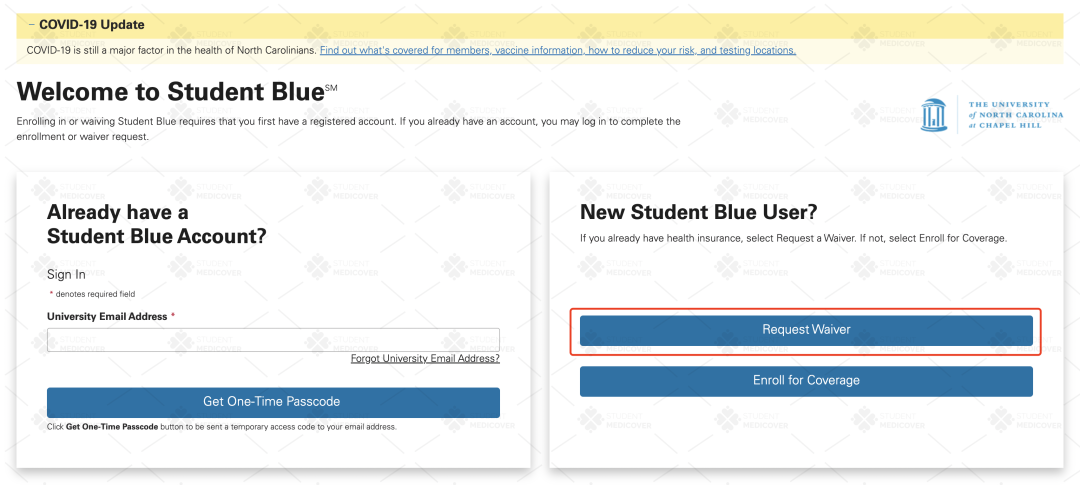

7. How to Enroll and Waive?

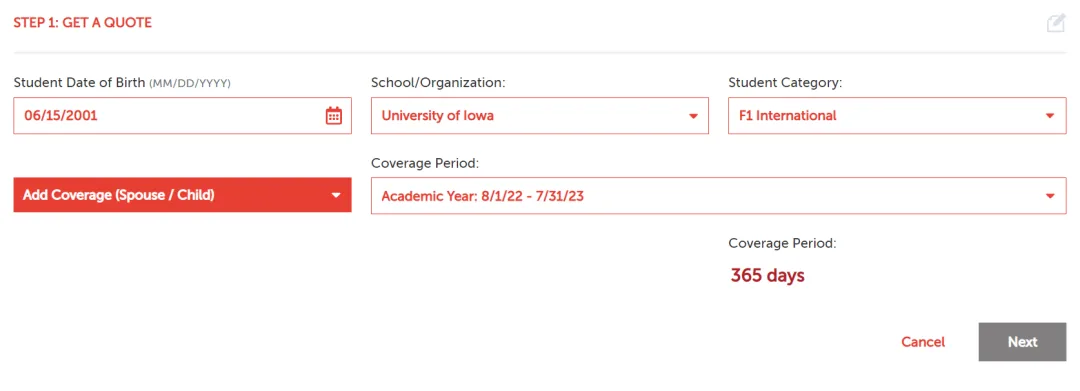

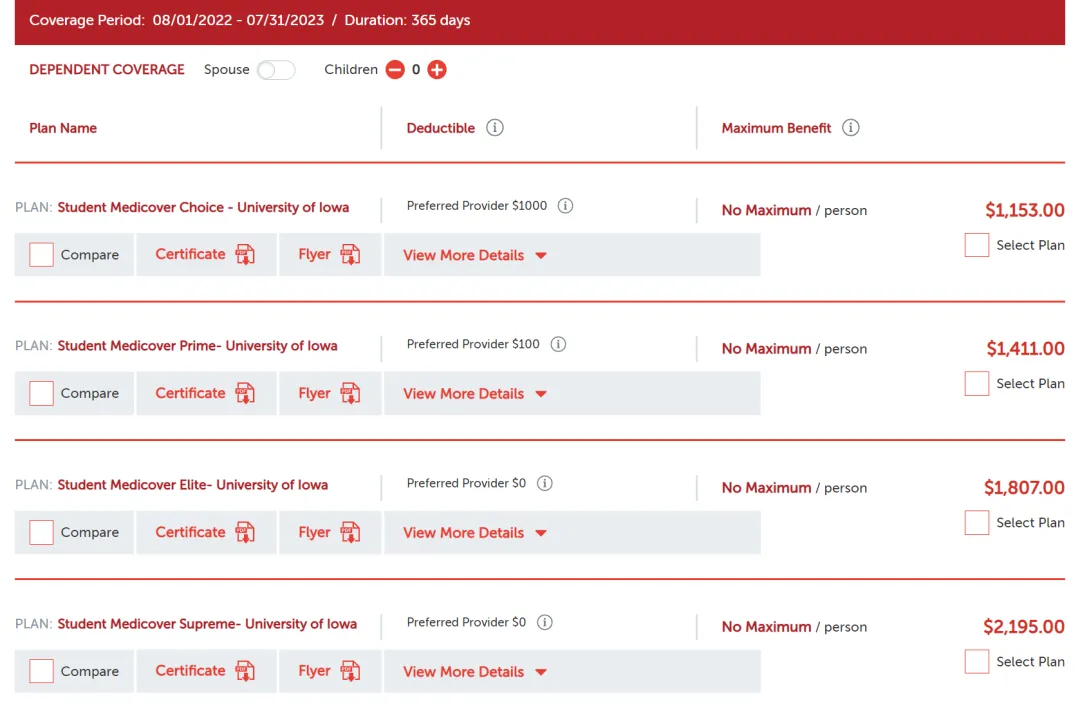

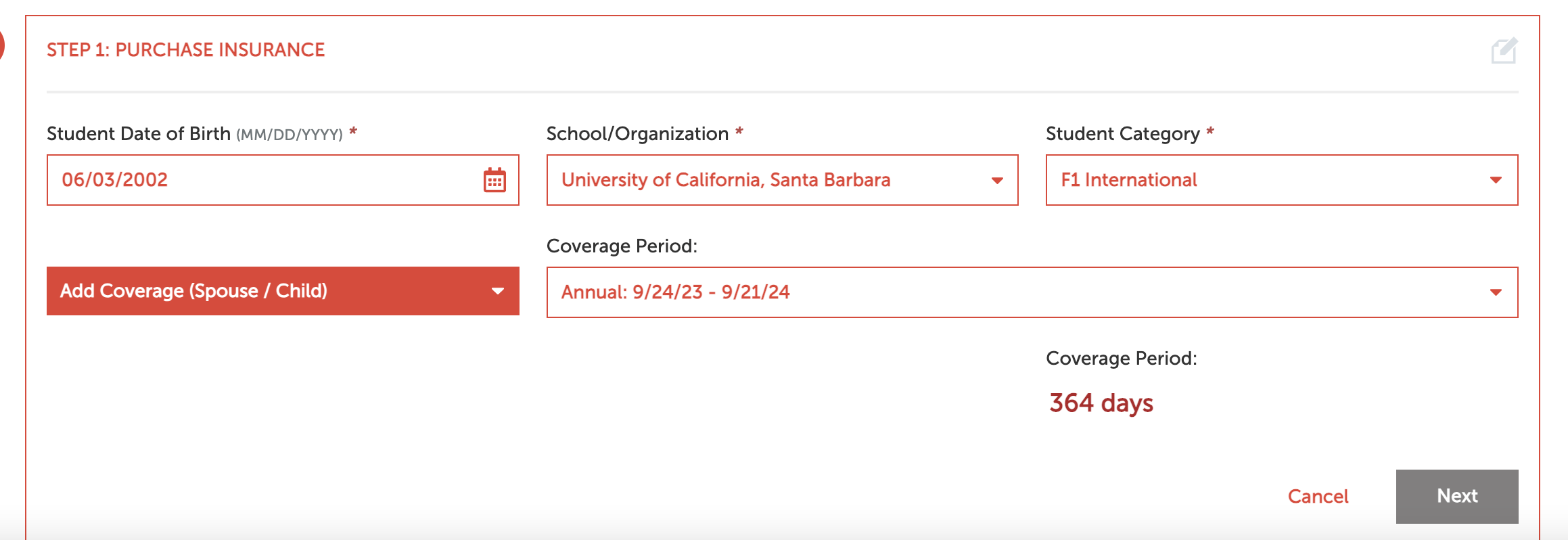

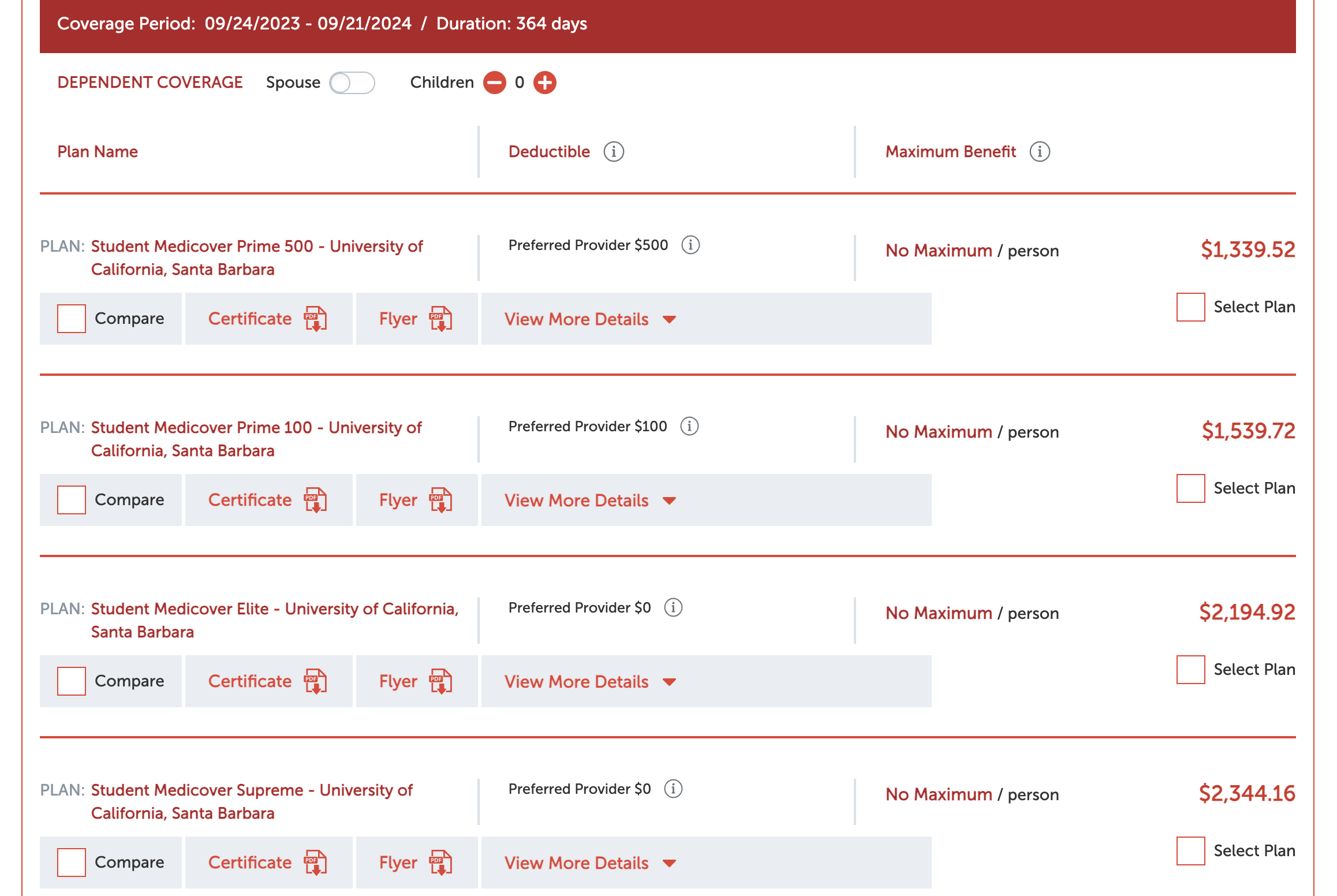

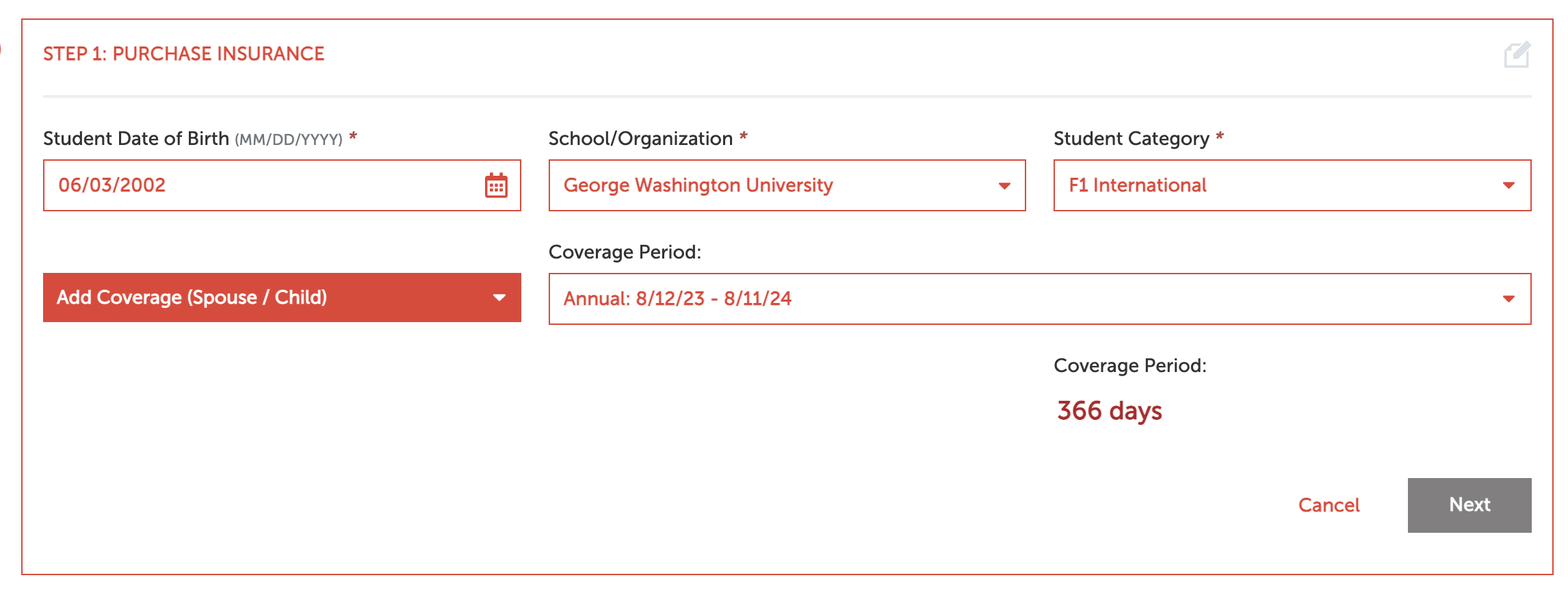

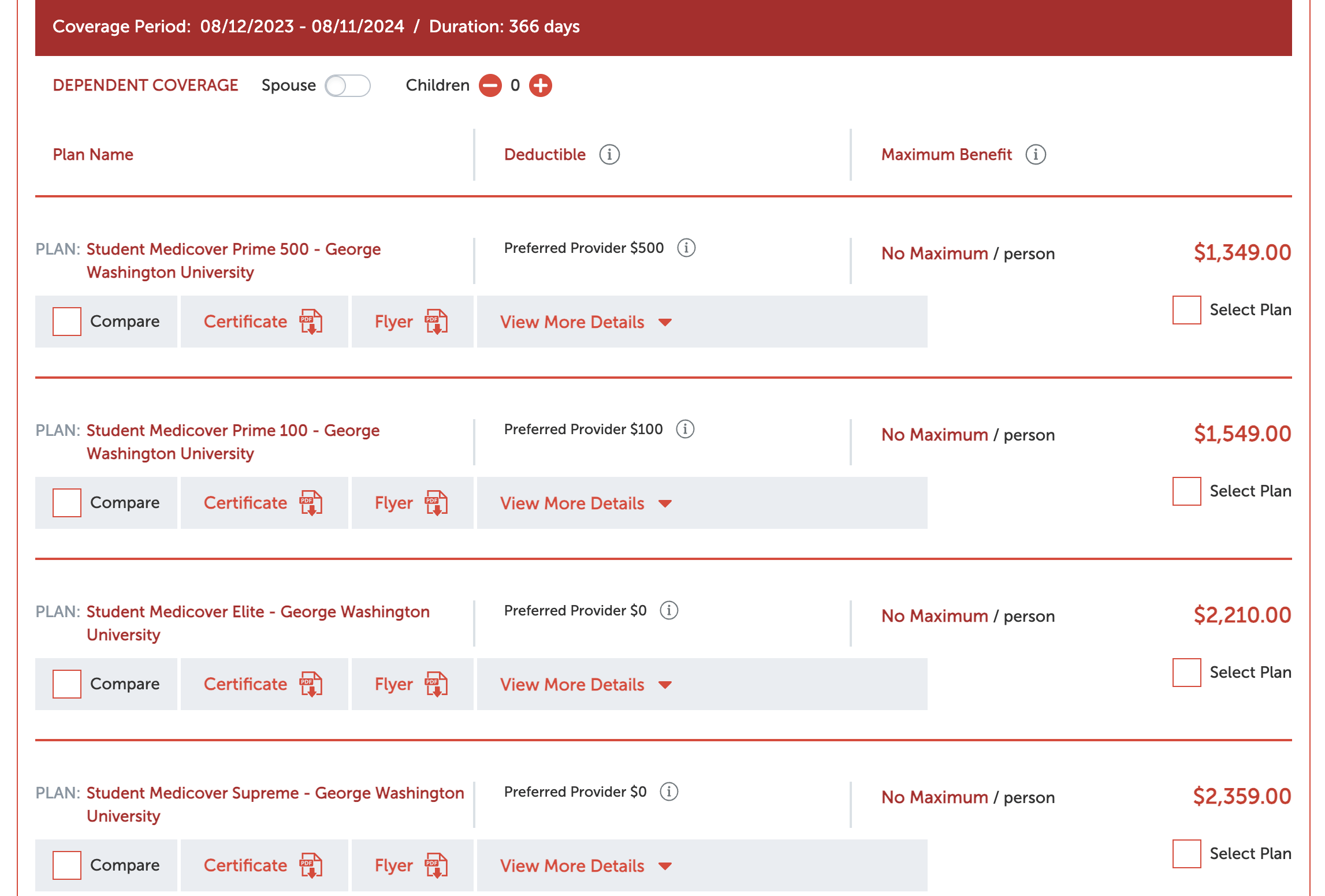

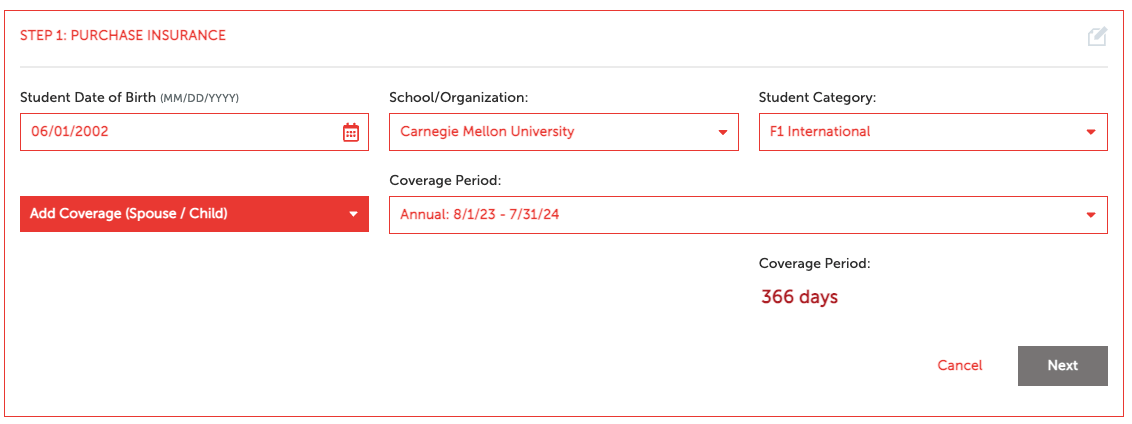

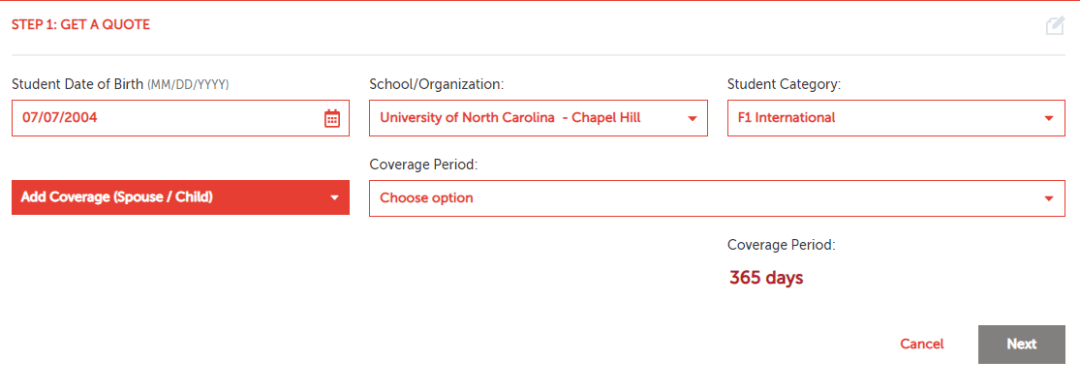

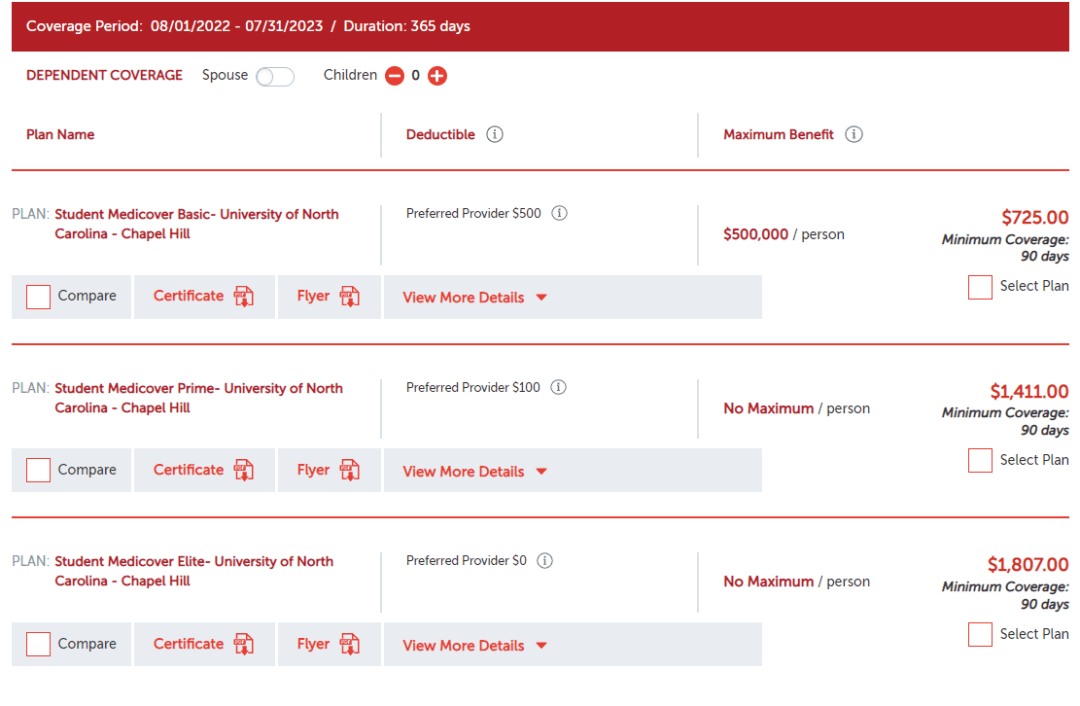

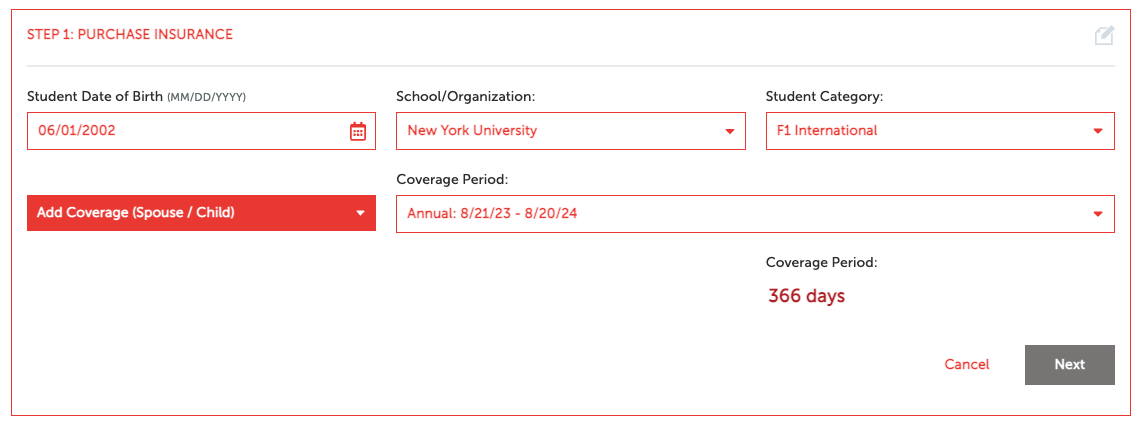

STEP 1

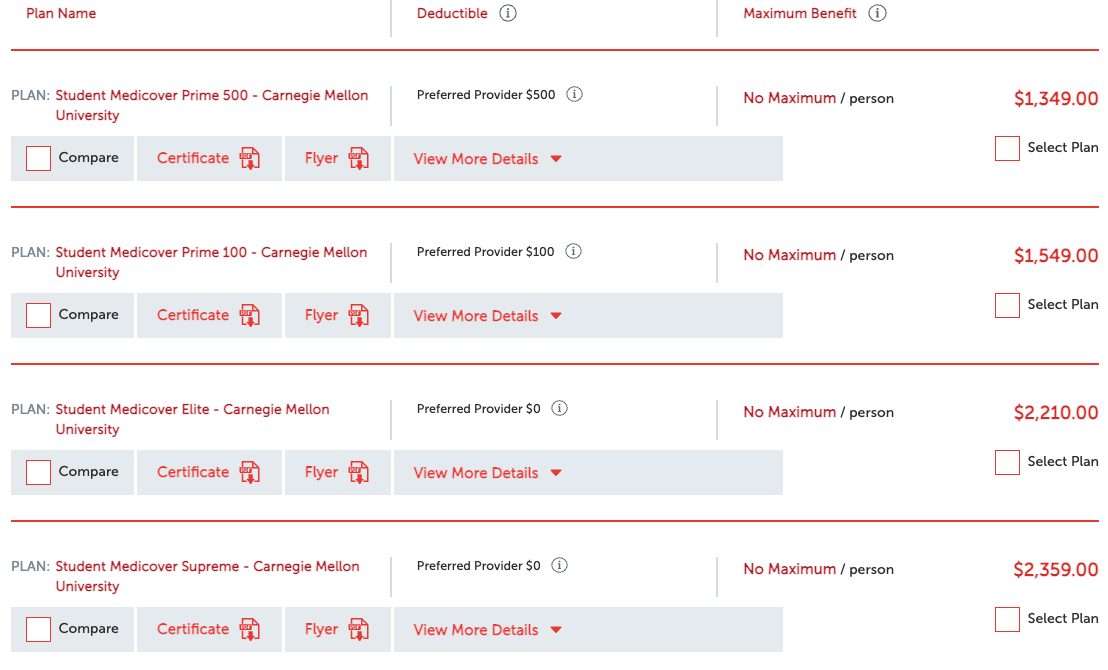

Enroll In an Insurance Plan

Visit smcovered.com, scroll down to "Enrollment"

- Choose your Date of Birth

- School: Choose New York University

- Student Category: F1 International

- Coverage Period: 8/21/23-8/20/24

Supreme, Elite, Prime 100,Prime 500 plans meet the school's requirements to ensure the success of waive! Supreme and Elite plans are the most popular plans with the lowest deductible and the highest coinsurance.

Note:

-If you find duplicate charges or your payment has been canceled, please contact us as soon as possible.

-To avoid incurring additional fees, we recommend selecting alternative bank cards when making payments, as both BOA and PNC banks charge a handling fee for transactions.

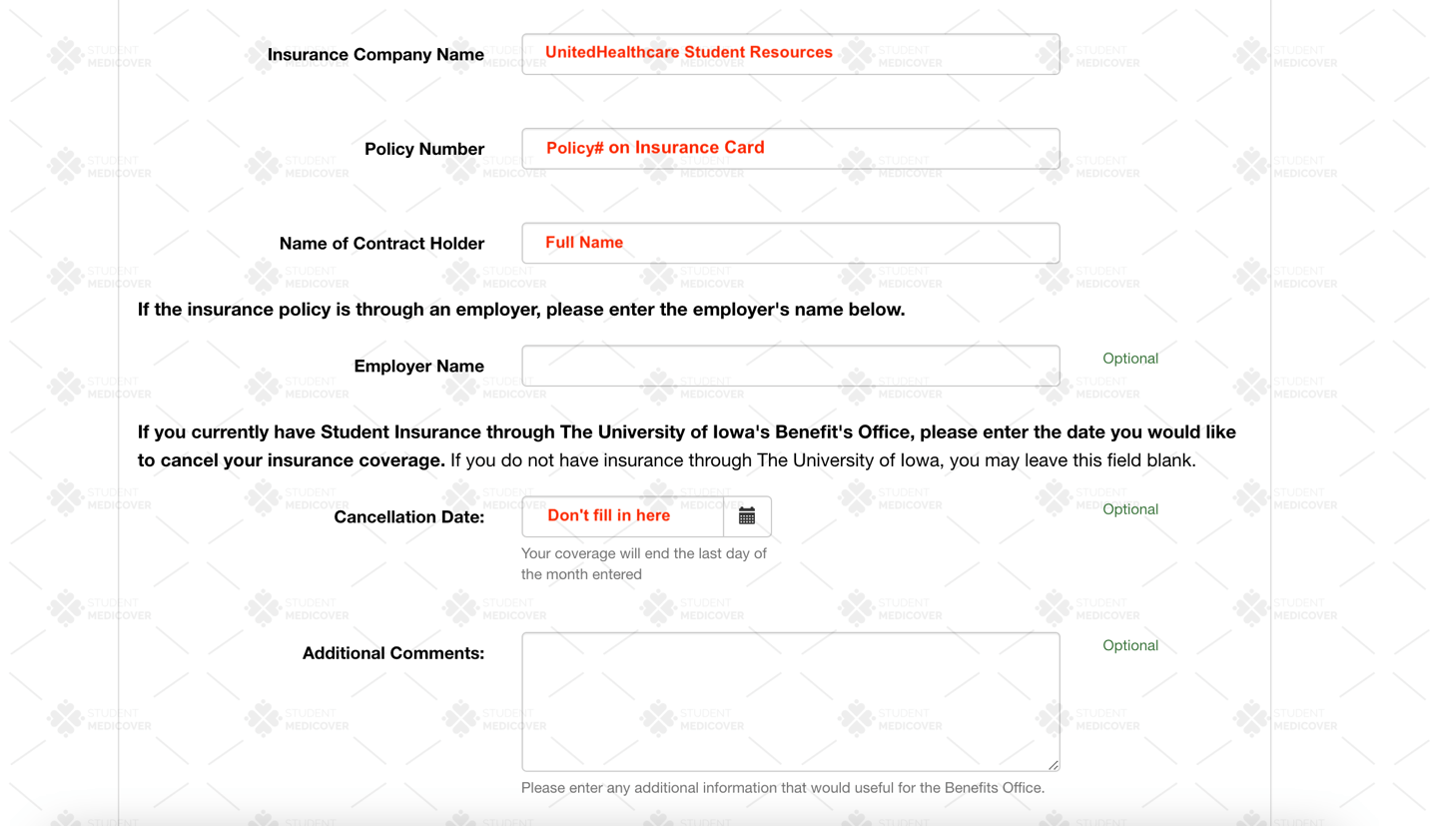

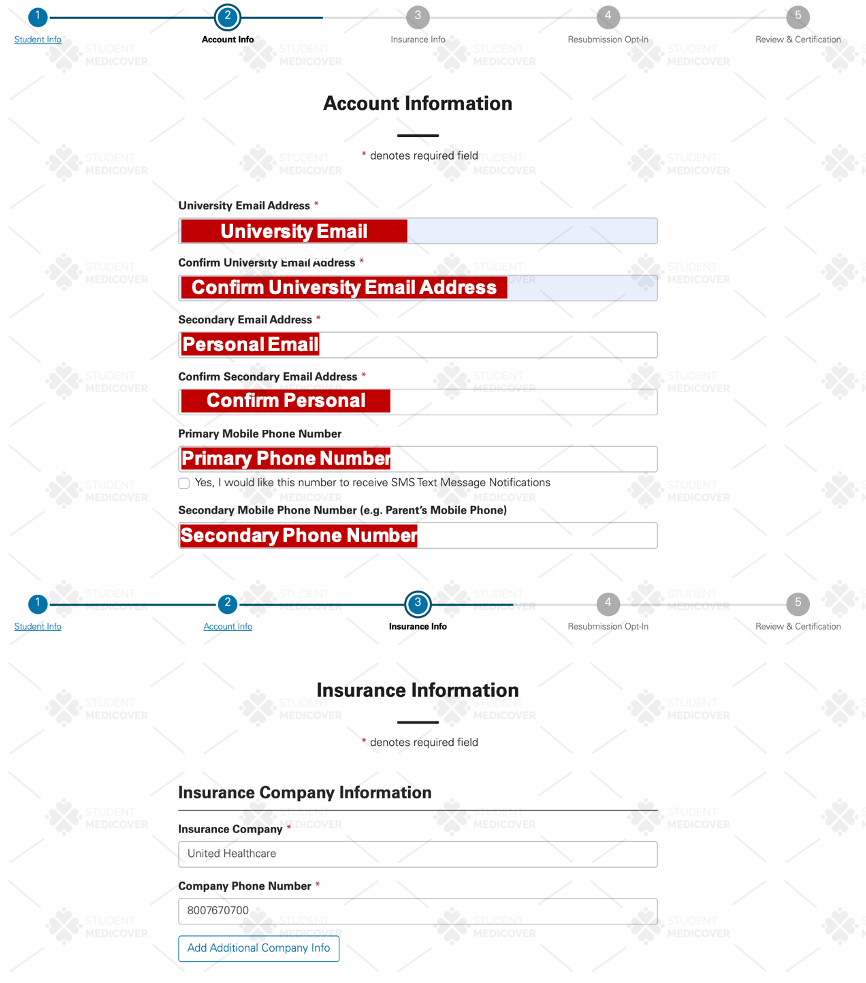

STEP 2

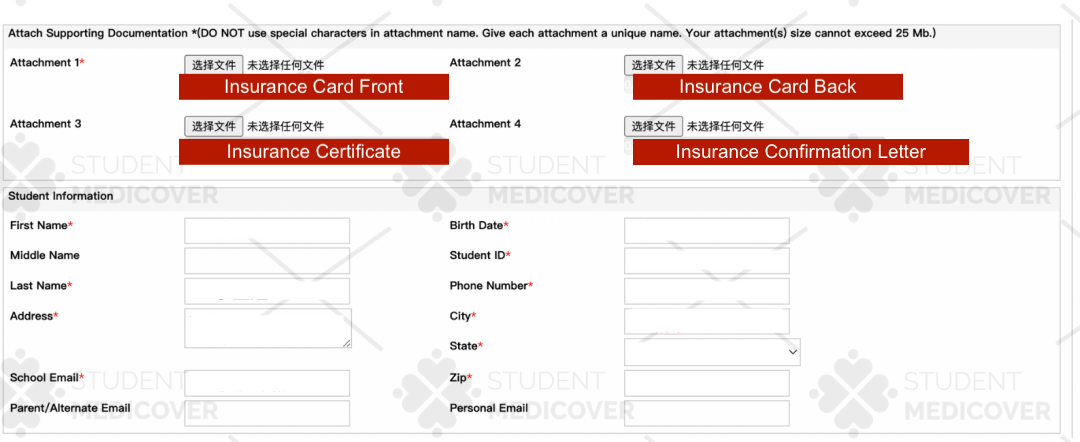

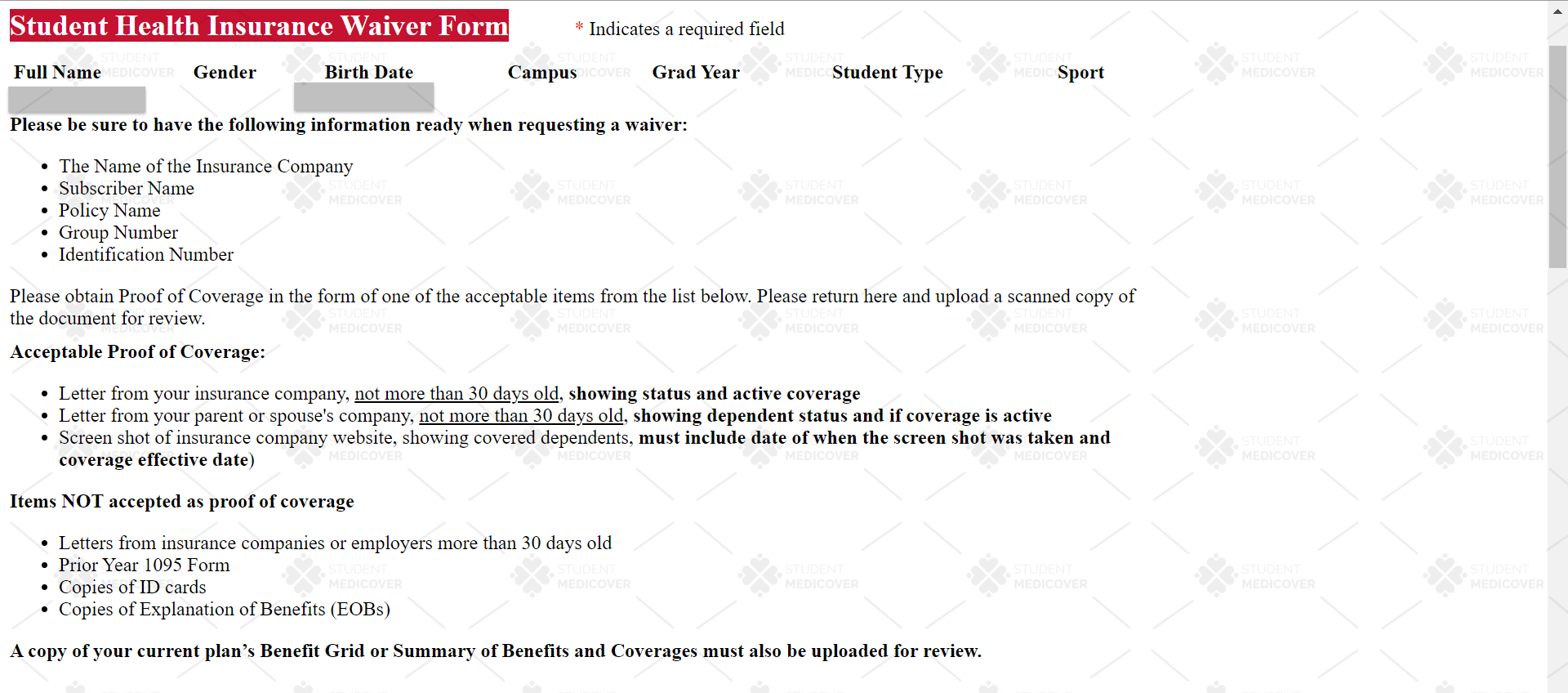

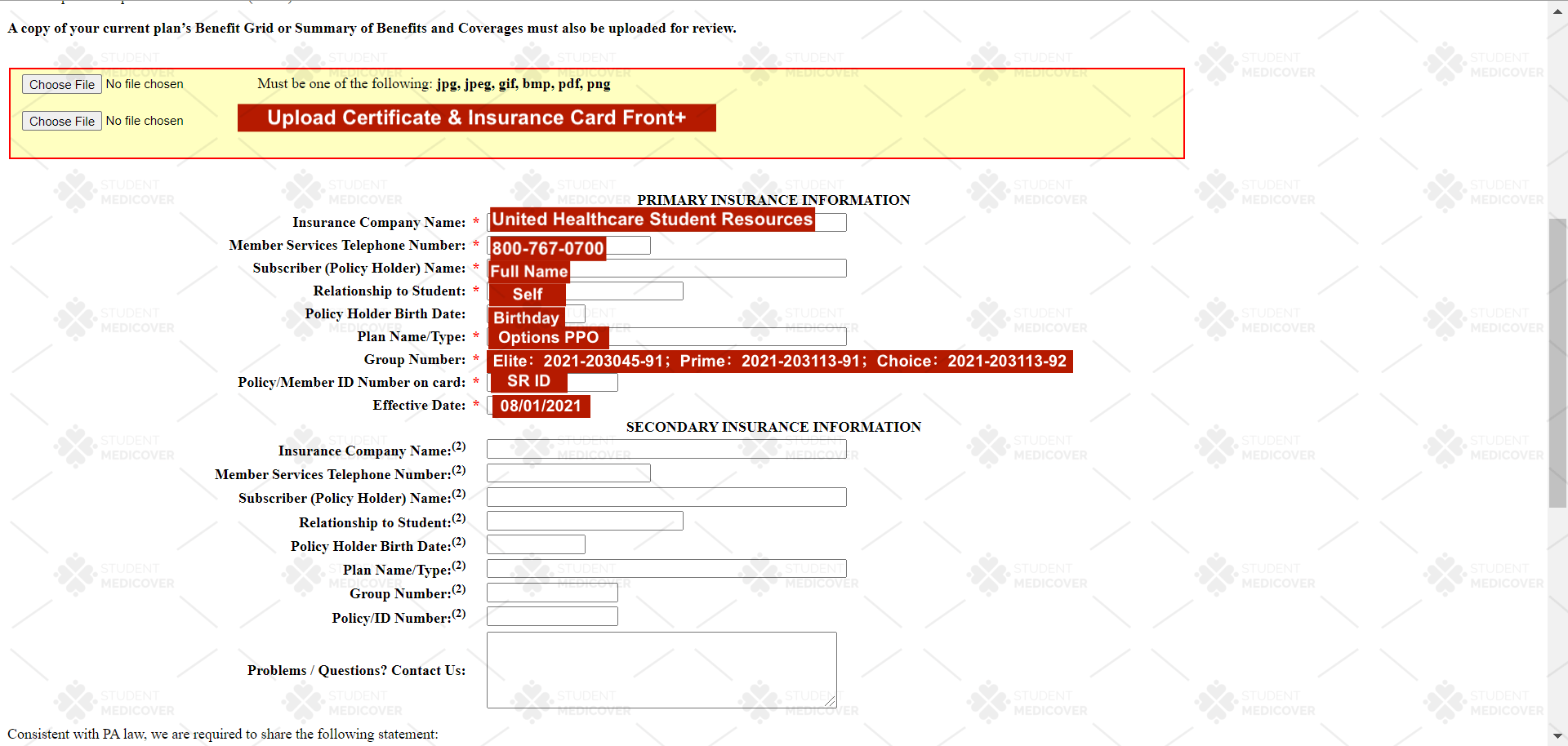

Prepare Waiver Required Documents

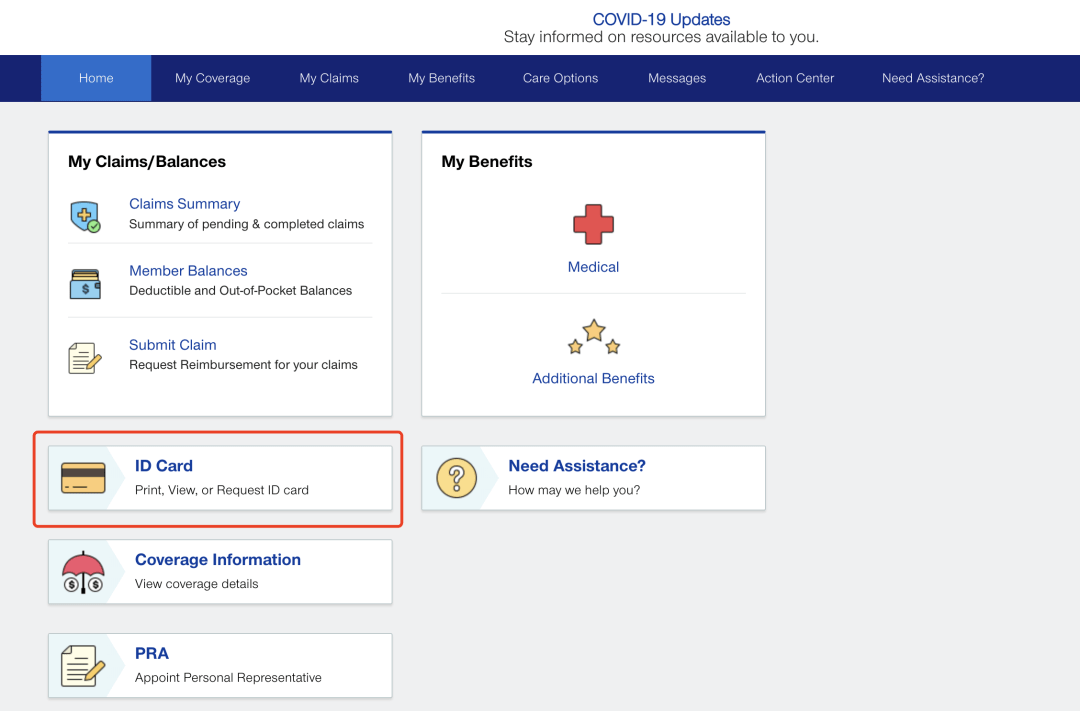

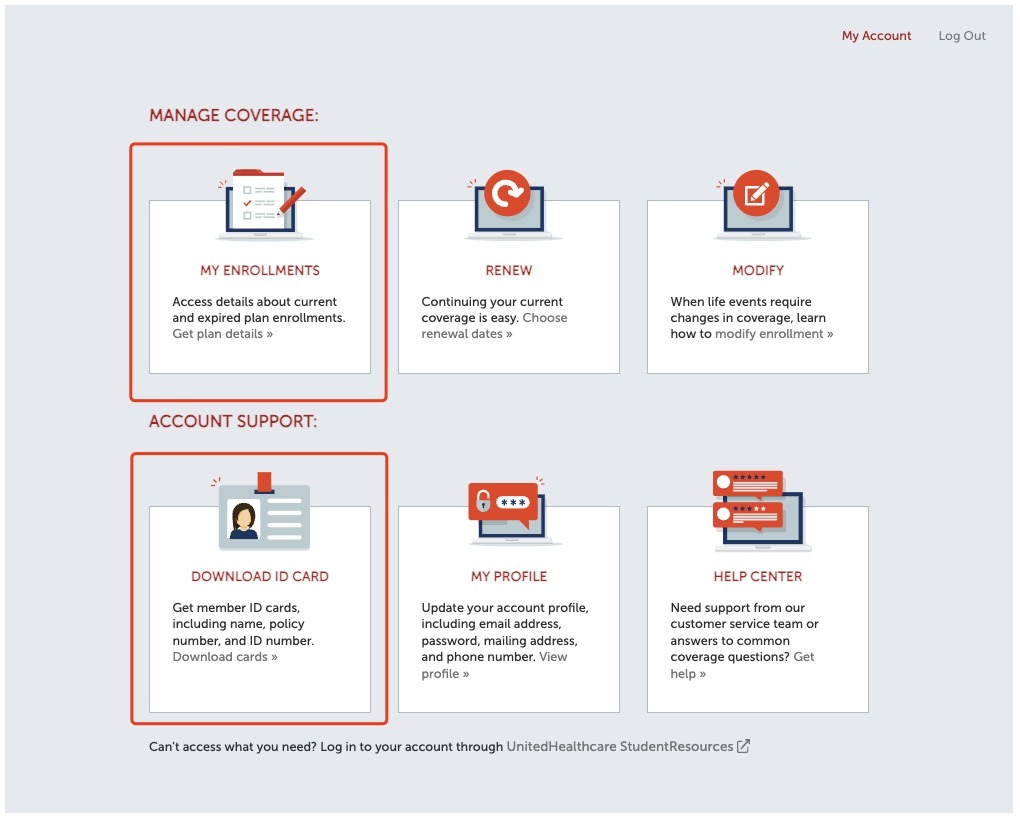

1.Download Your Confirmation Letter and Temporary Insurance ID Card

-Go to smcovered.com to log in:

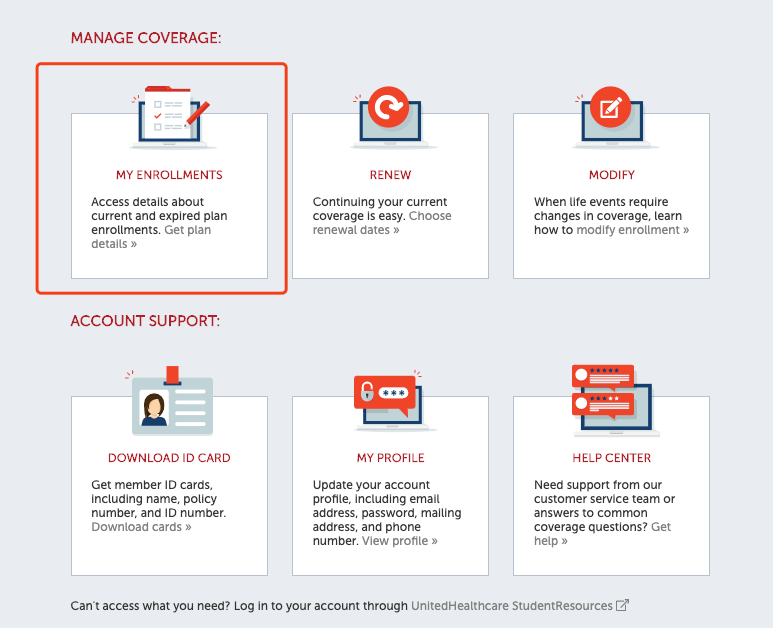

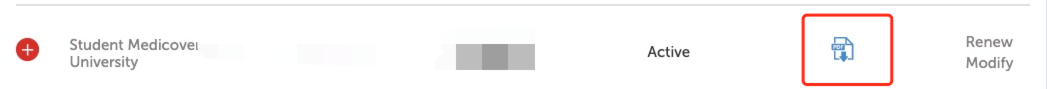

click "MY ENROLLMENTS" to download the confirmation letter.

click "DOWNLOAD ID CARD" to download the temporary insurance ID Card.

*If you are in urgent need of submitting the waiver, you can do so by providing a temporary insurance ID card.

*The temporary insurance ID card is for insurance waiver and registering insurance accounts only.

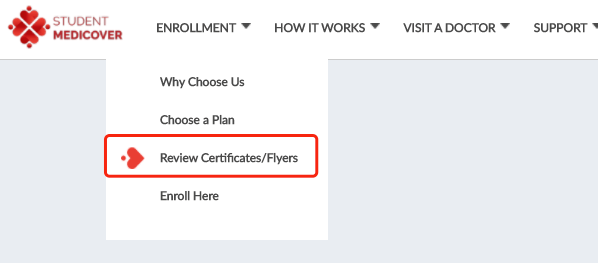

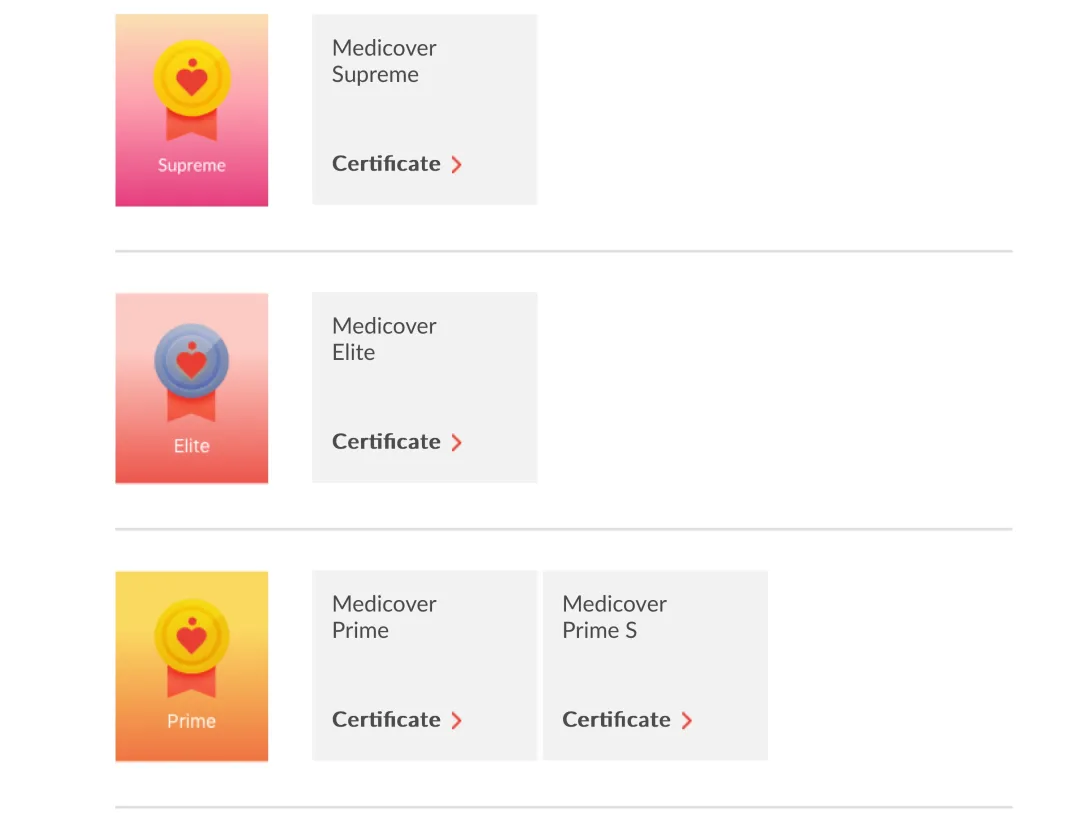

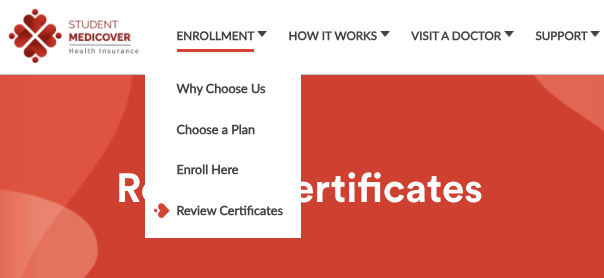

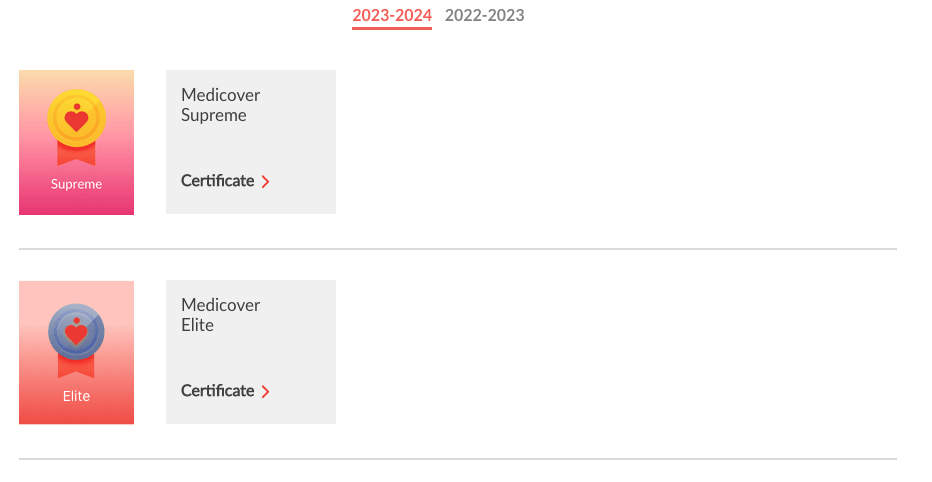

2.Download Your Insurance Certificate

-Go to smcovered.com and find "Review Certificates" in the "ENROLLMENT".

-Download the certificate of the insurance plan you enrolled.

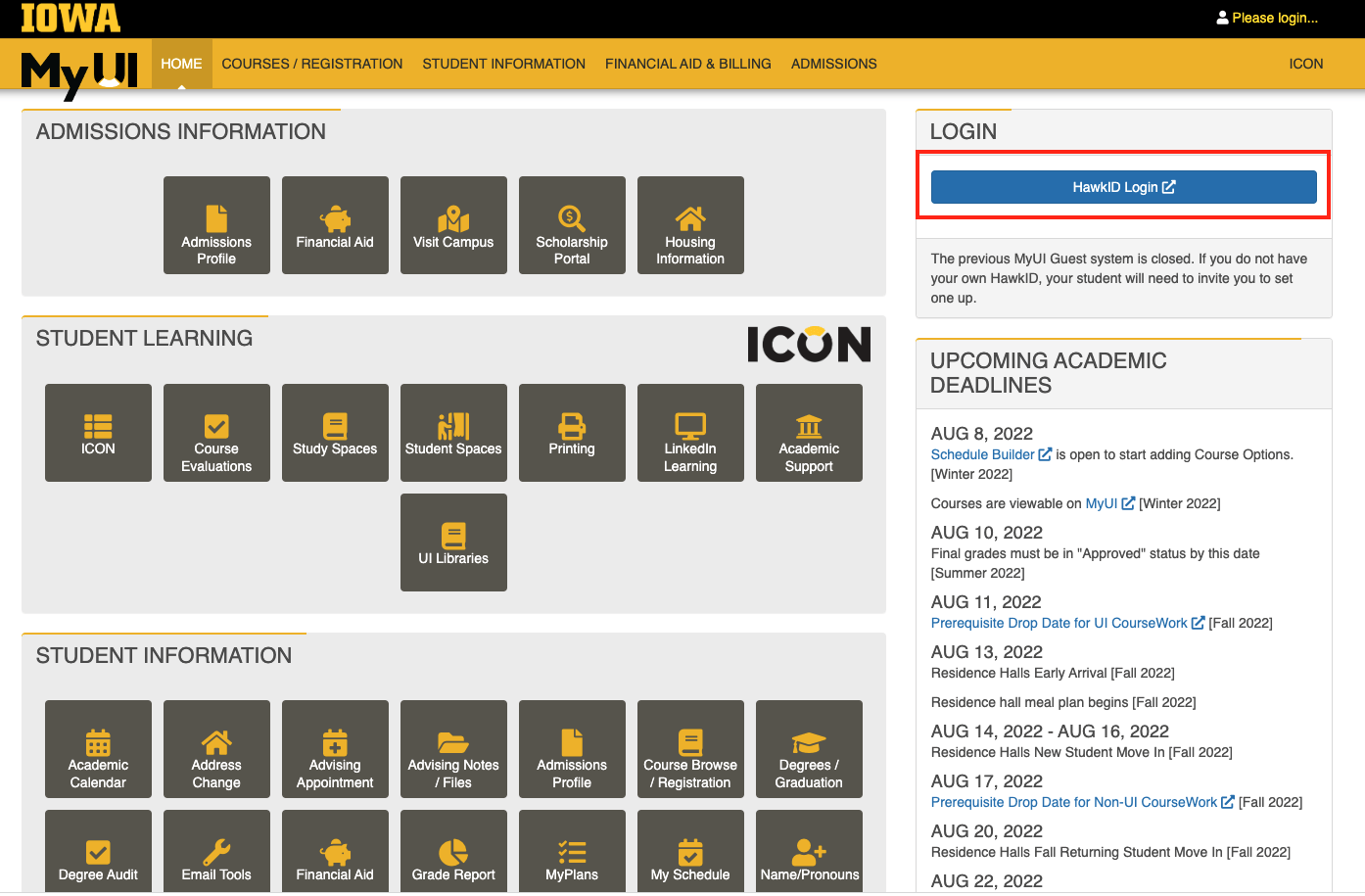

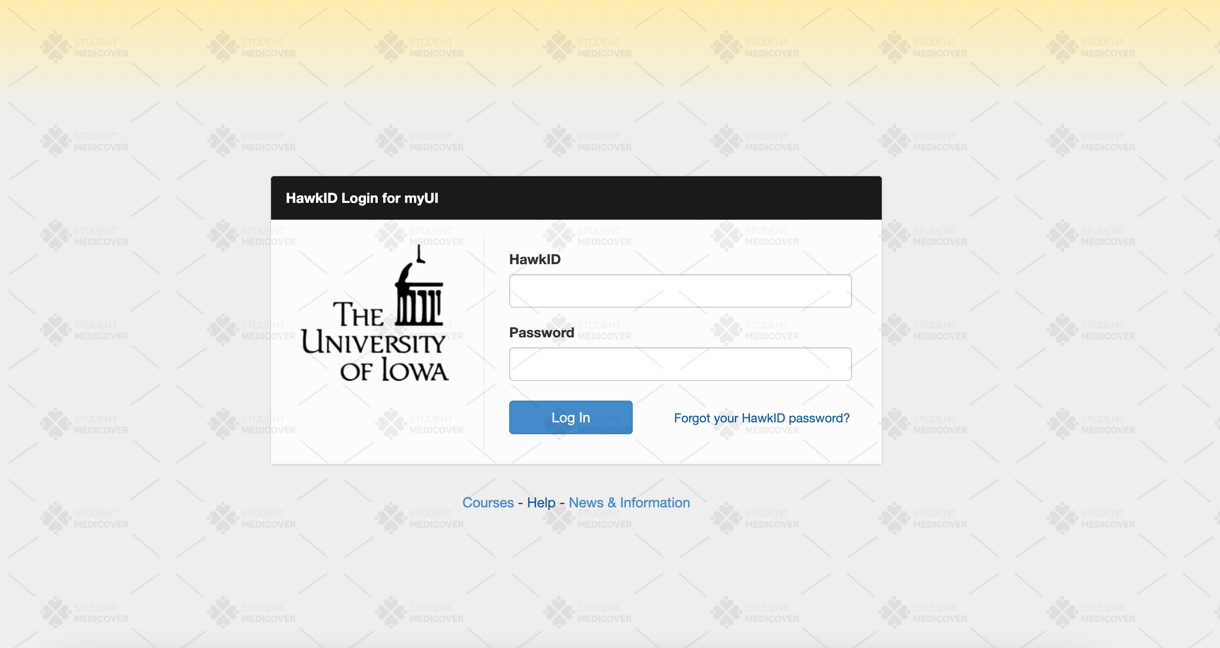

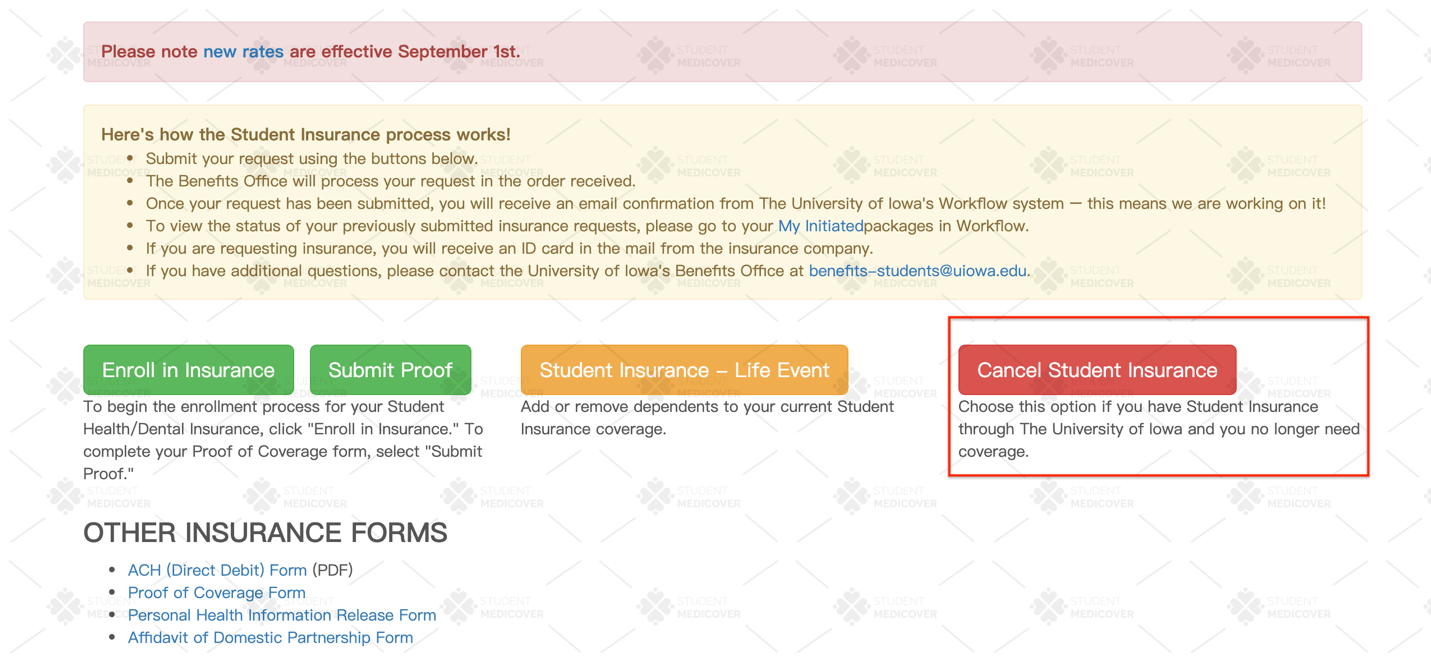

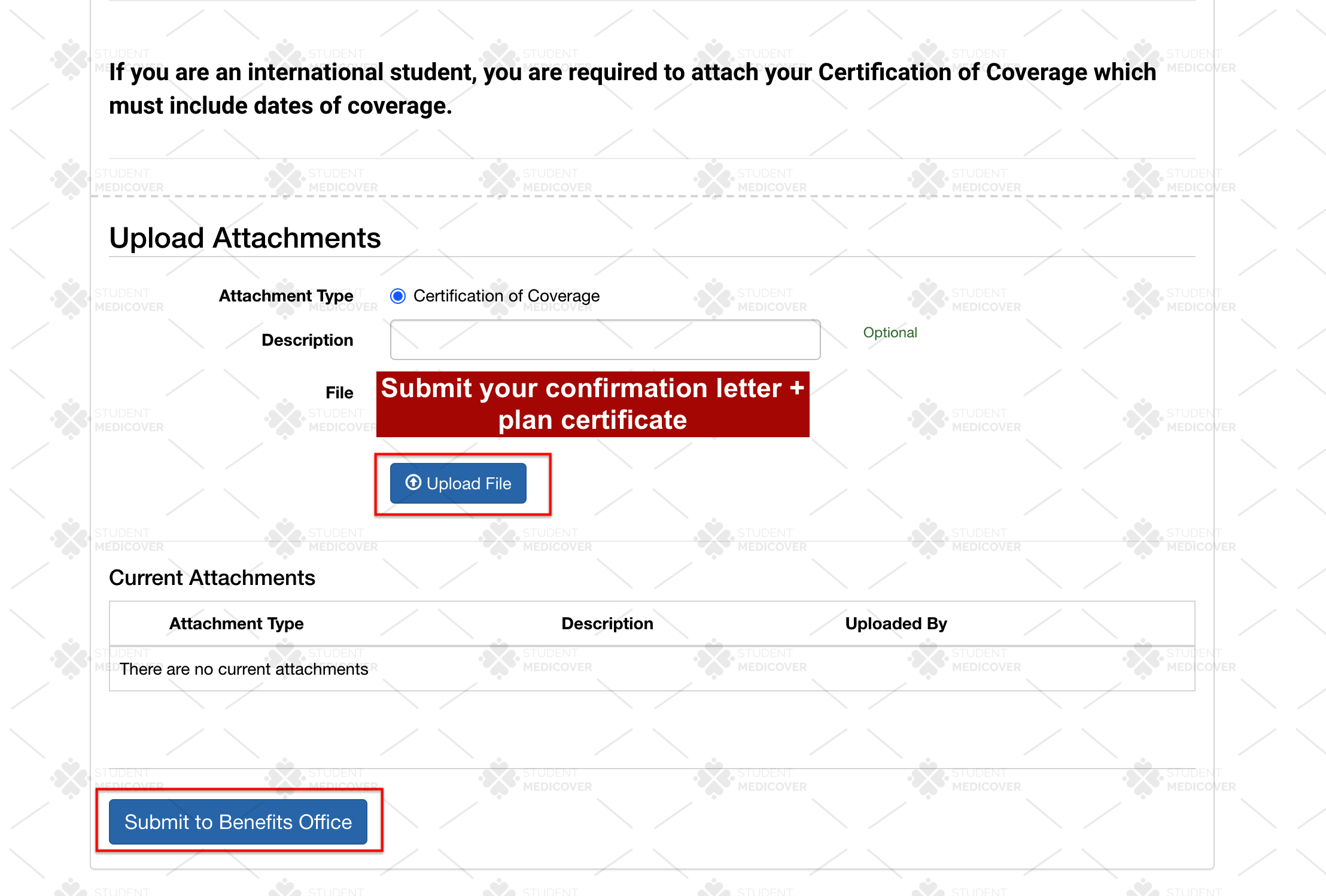

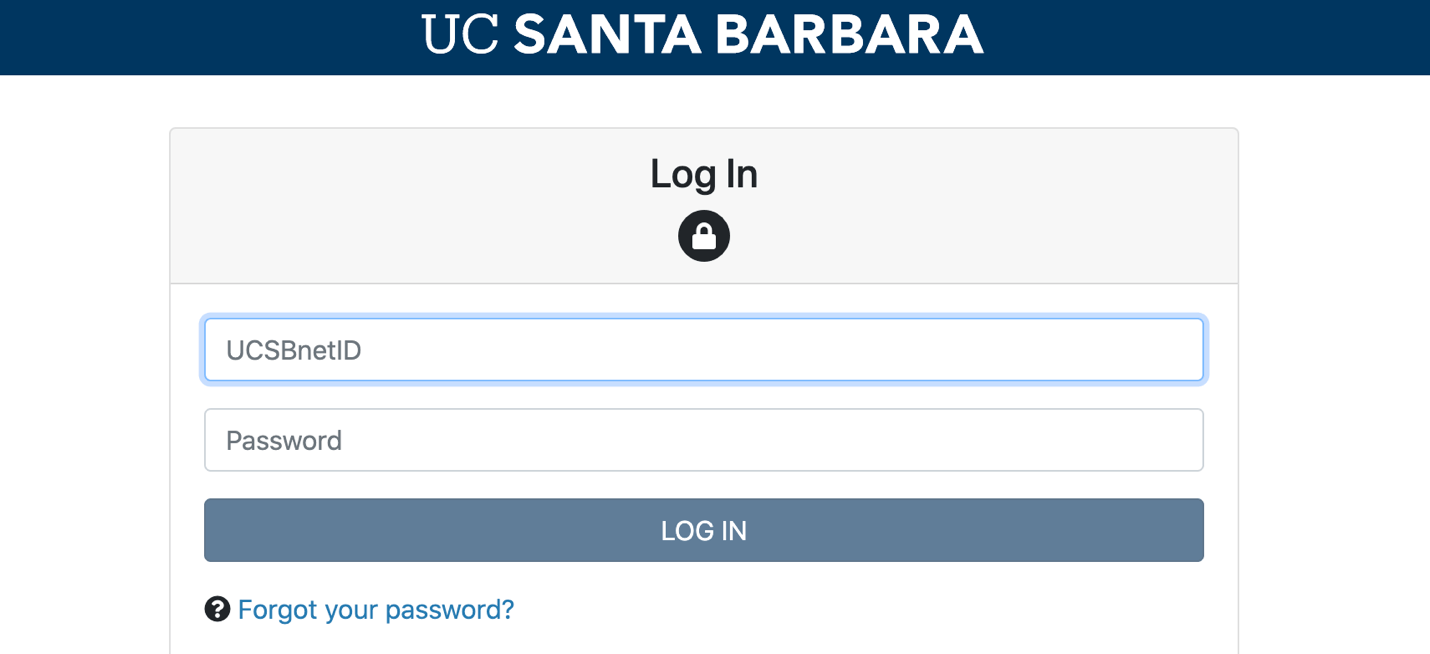

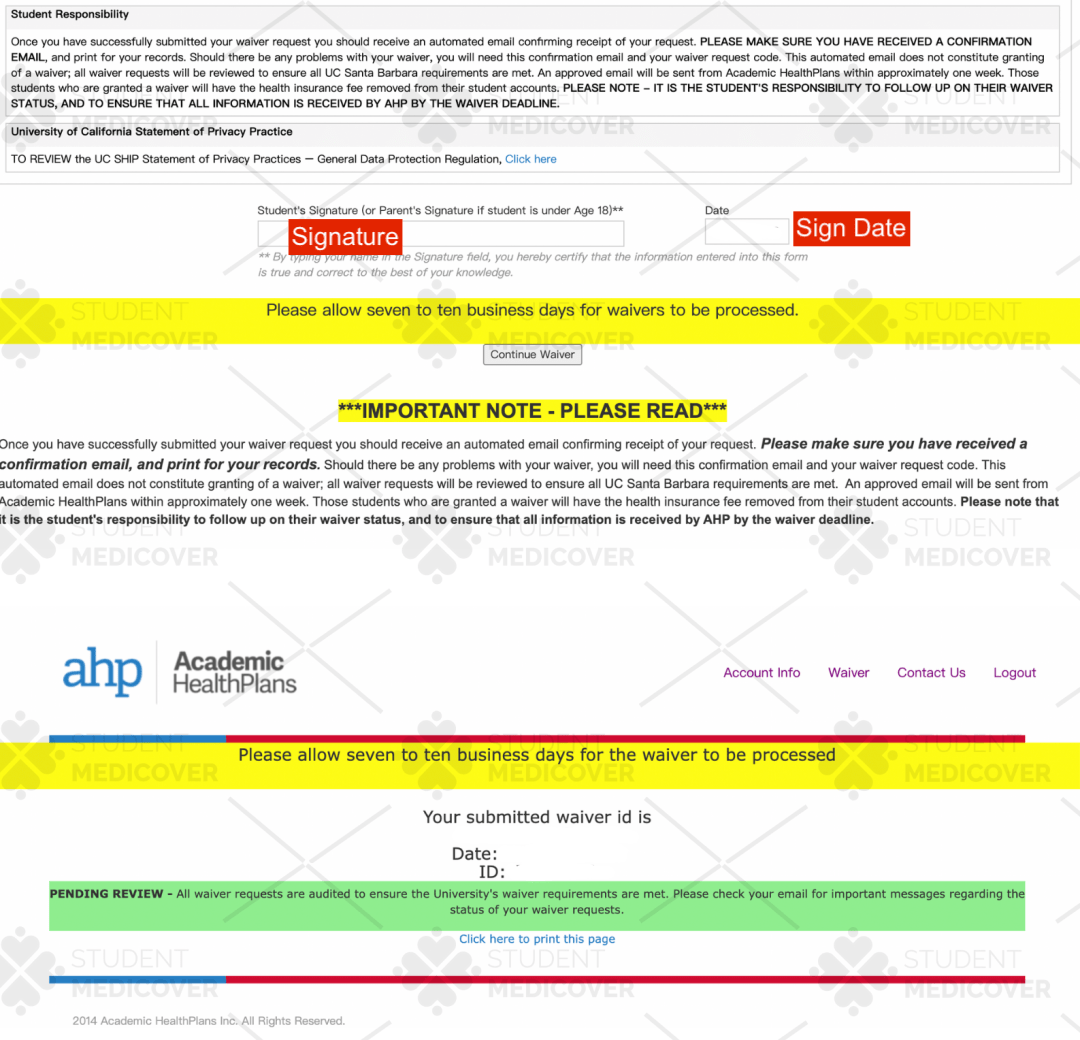

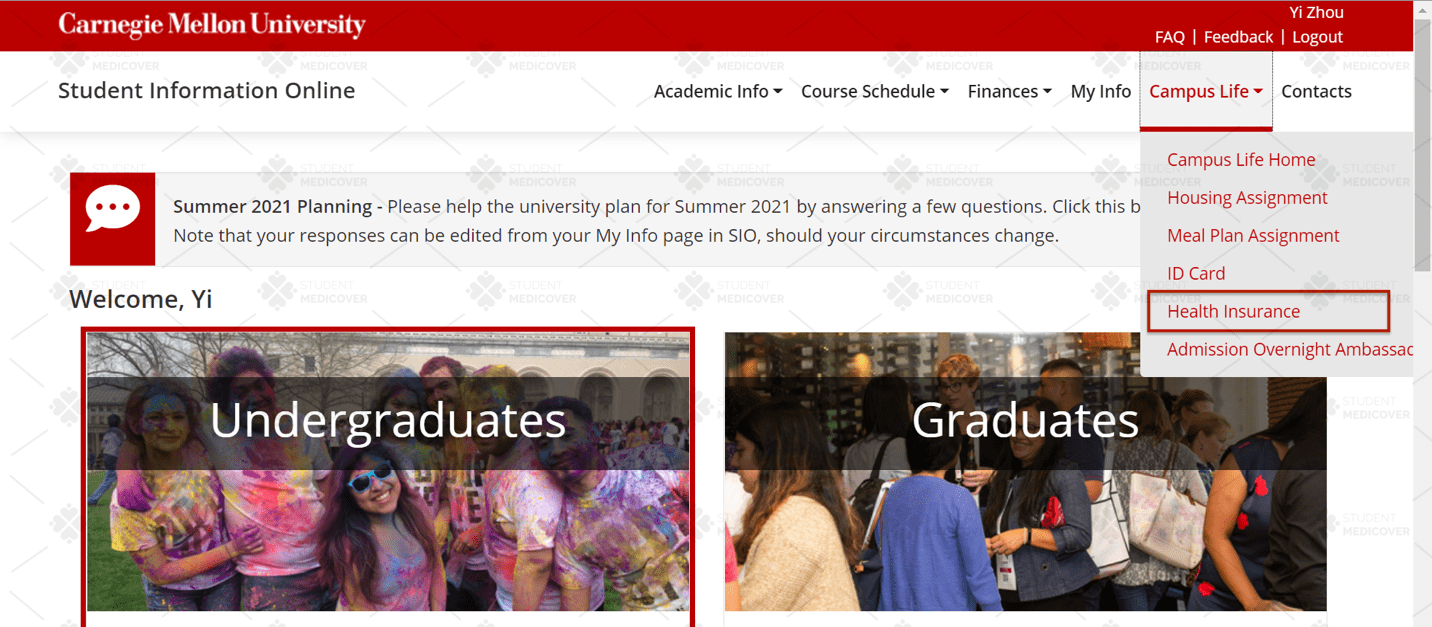

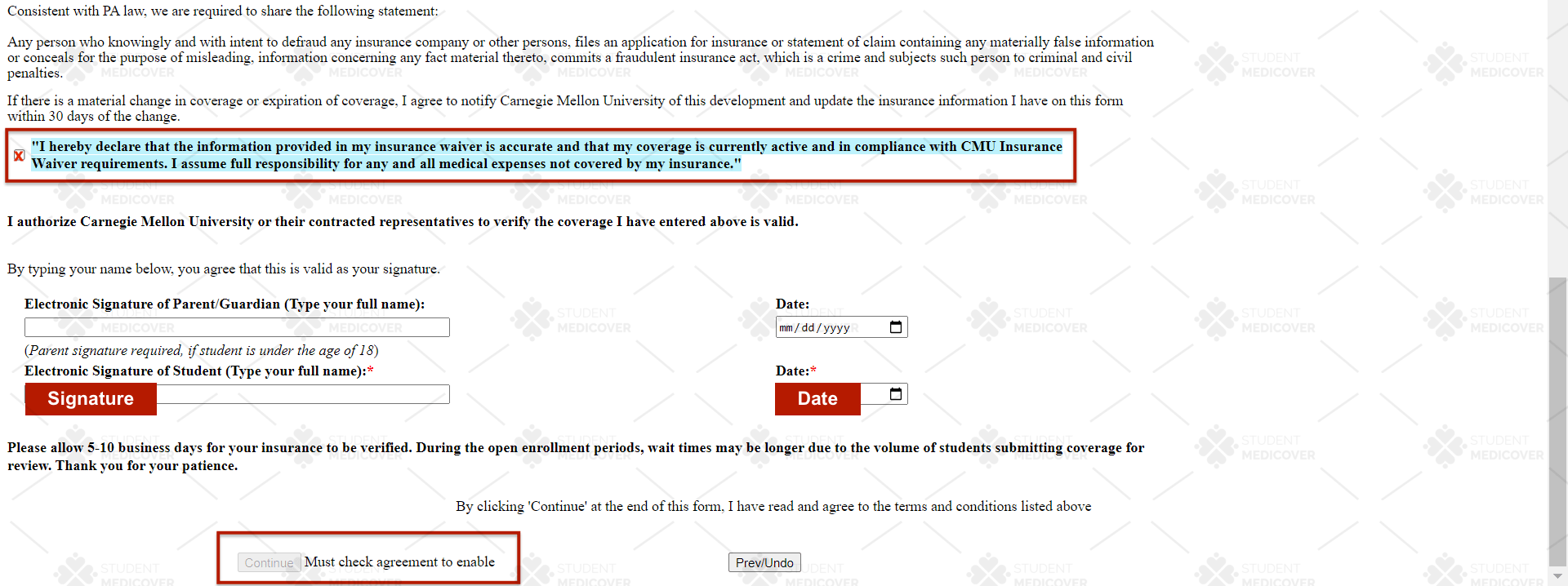

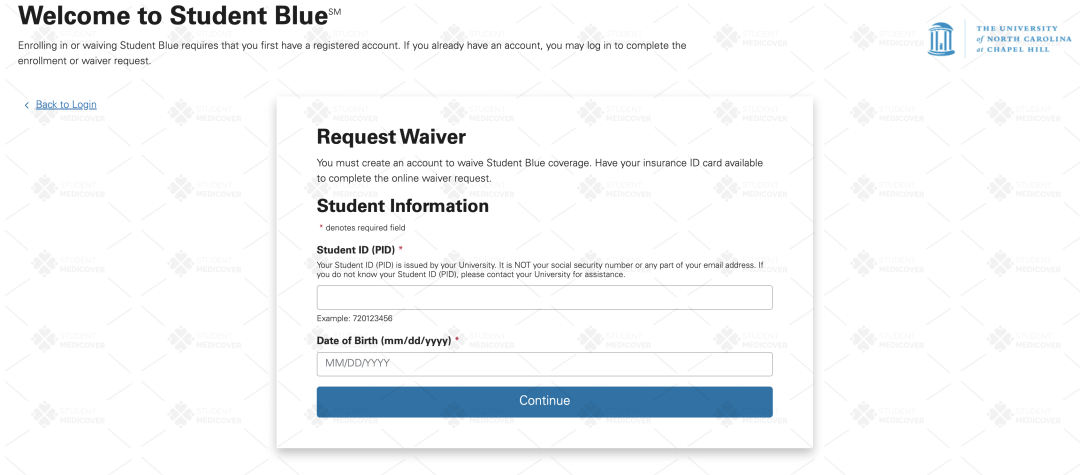

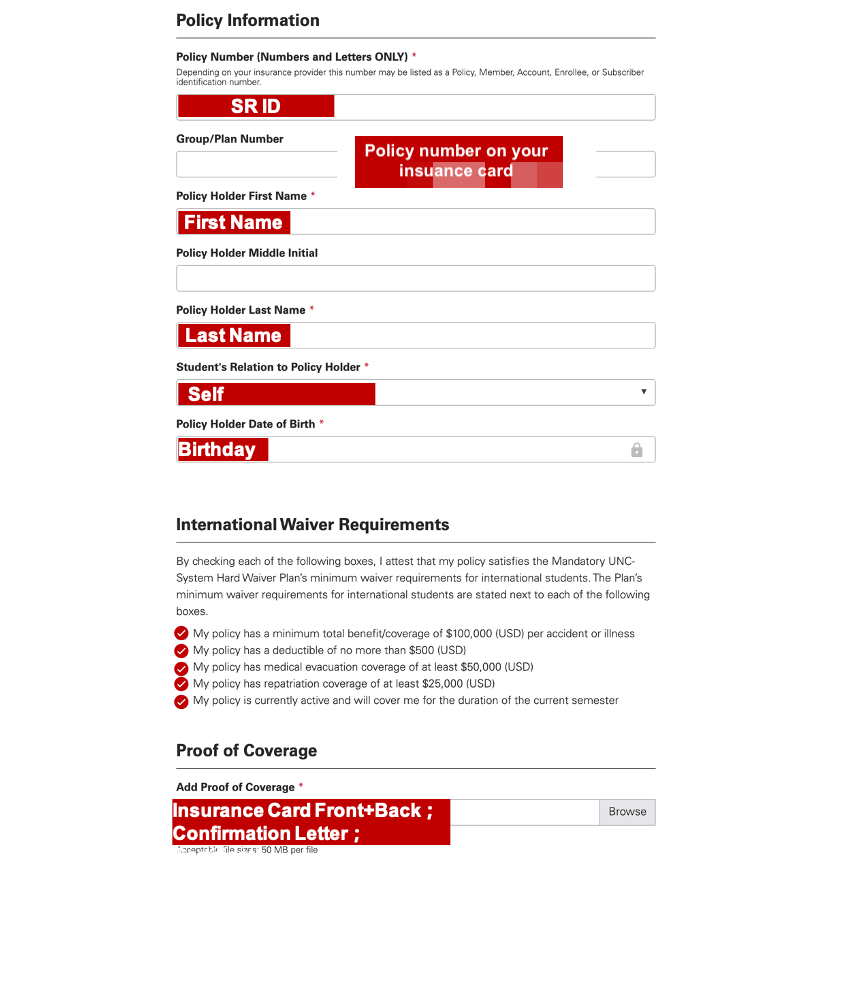

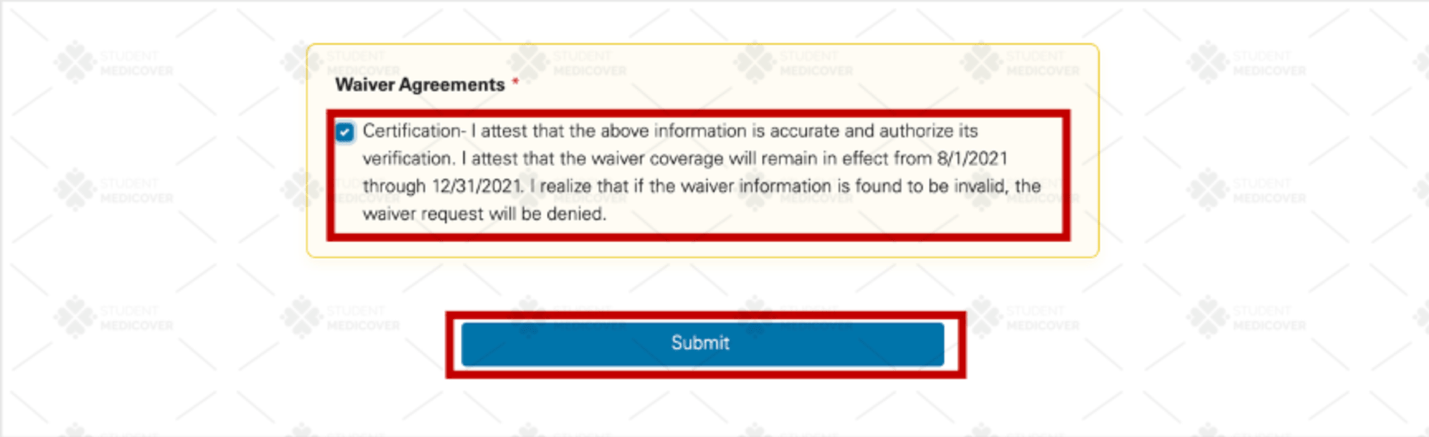

STEP 3

Waive School Insurance

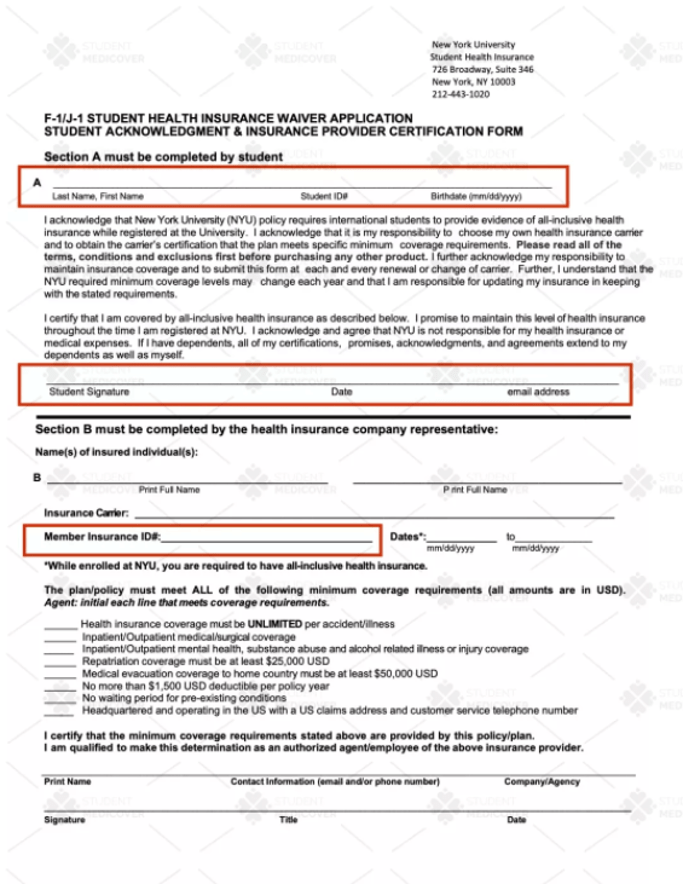

1.Collect and fill out the Waive form

Within one working day after the purchase is completed, you

can receive the Waive form provided by Student Medicover in

the mailbox used at the time of purchase.

After receiving the form, fill in the complete information

in the two places of Section A, fill in the Member

Insurance ID (SR ID on the insurance card) in

Section B, and confirm that the information on the form is

correct~

2. Submit the Waive form to the school

Send the form to the school insurance office email:

health.insuranceattestation@nyu.edu

Or submit to the school insurance office:

NYU Student Health Insurance

726 Broadway,

Suite 346 New York,

NY 10003

212-443-1020

Tip: It is recommended that everyone try to use their own

NYU mailbox when sending emails, otherwise the email may

be ignored by the school insurance office~

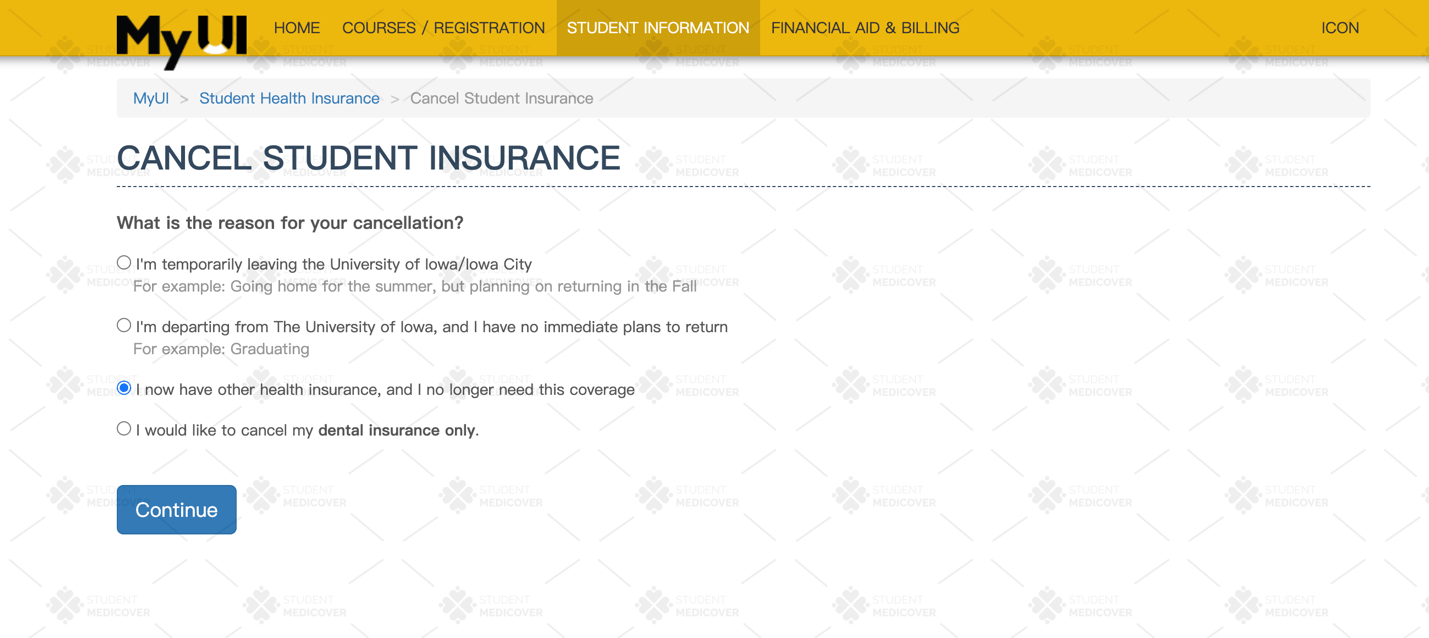

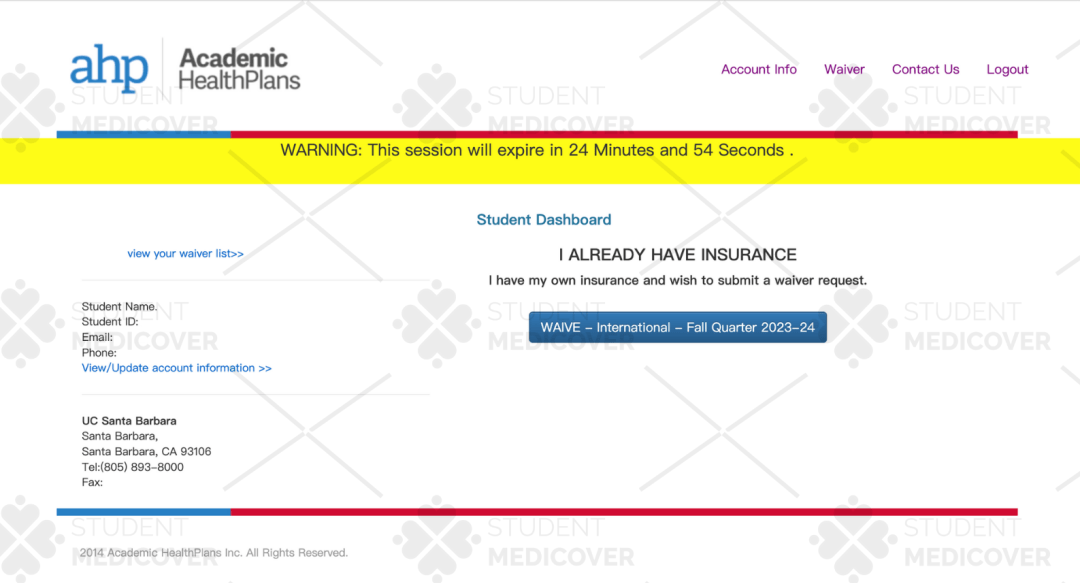

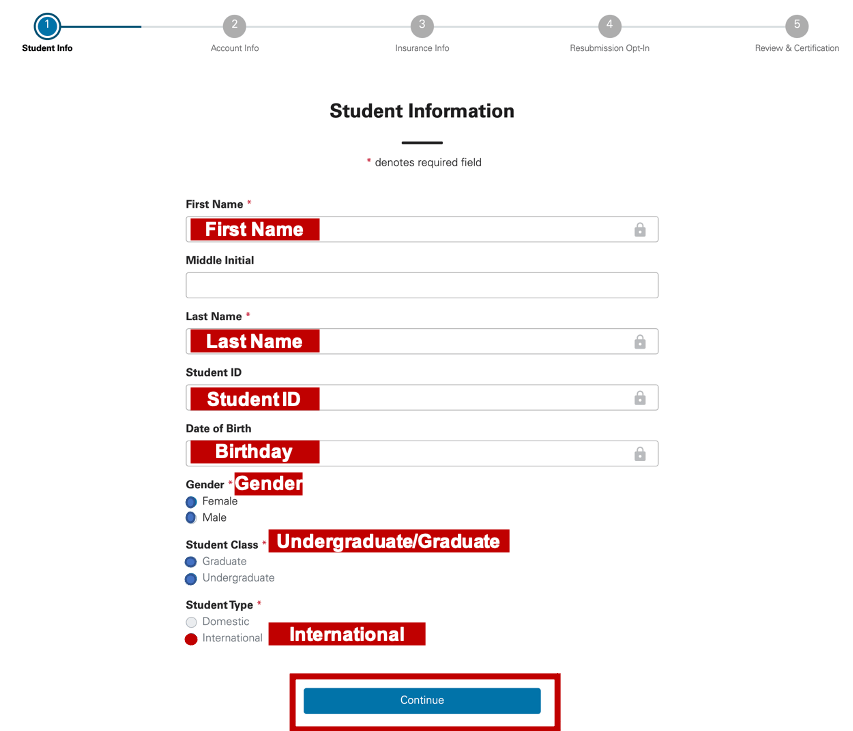

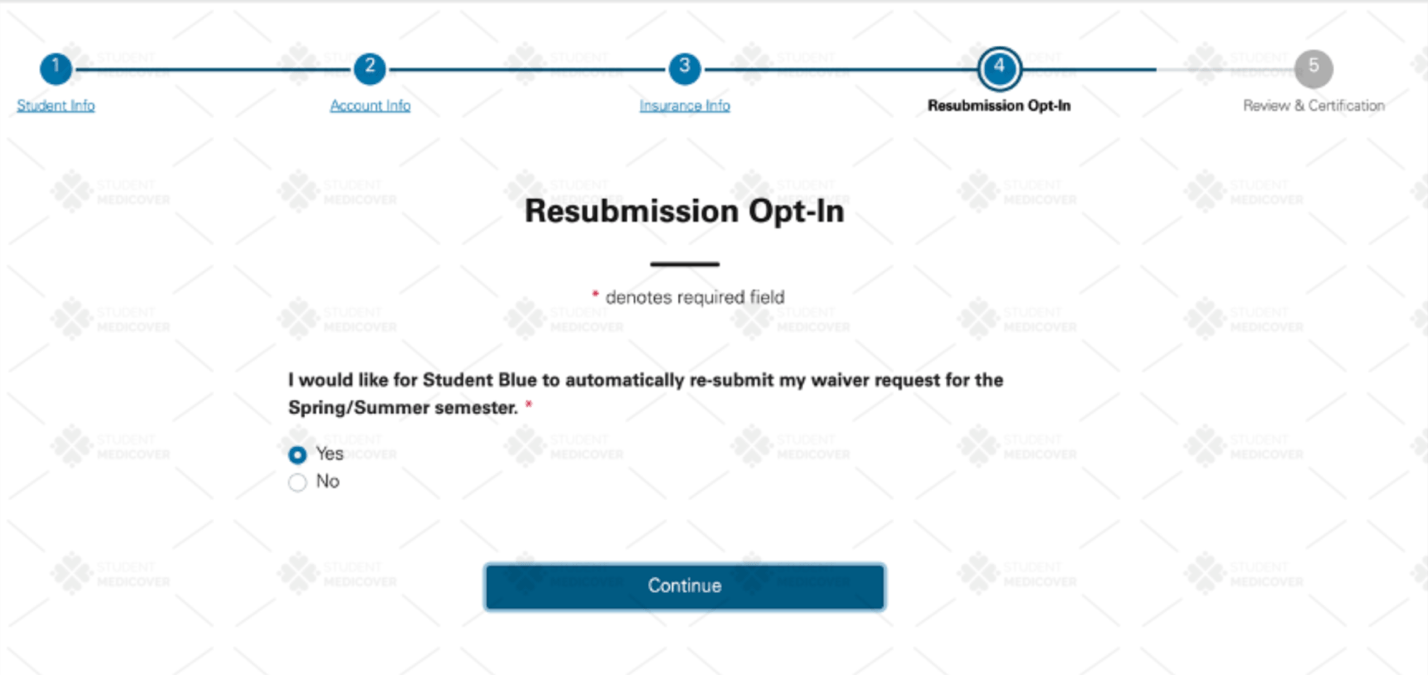

STEP 4

Register for Your HealthSafe ID Insurance Account.

To get your official Insurance ID card, you need to register for the HeathSafe ID insurance account.

*Due to a recent system upgrade in UHCSR, it will take 1-2 business days after the enrollment to be able to register for a HealthSafe ID insurance account and download the official insurance card.

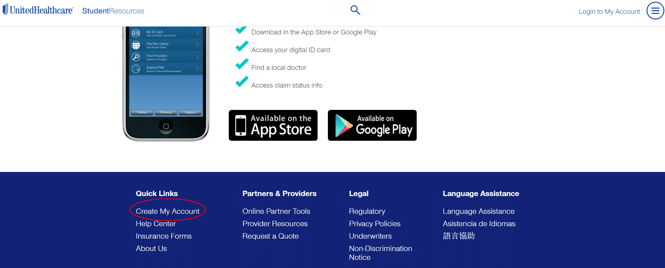

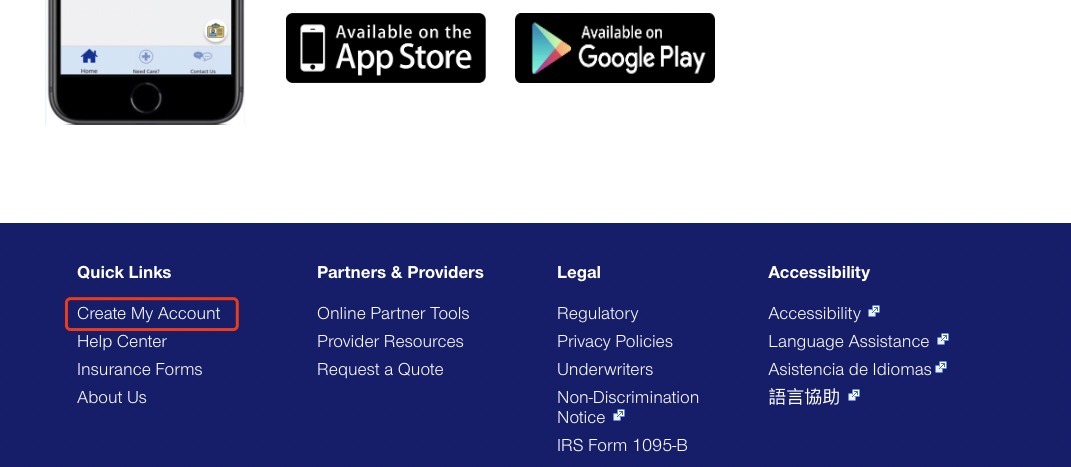

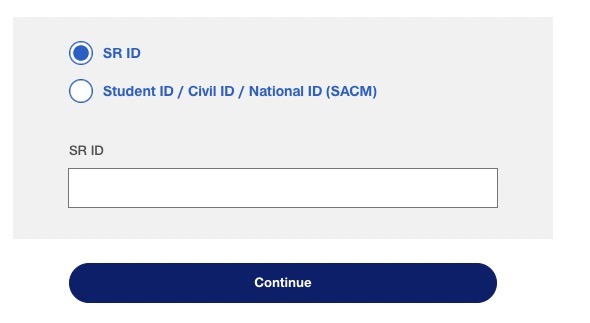

1.Go to UHCSR.com and select "Create My Account” at the bottom to register for the HeathSafe ID insurance account

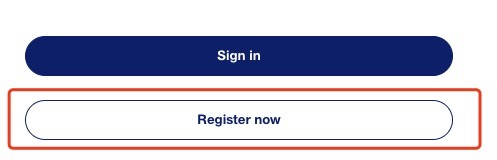

2.Select “Register Now”

3.Enter your name, date of birth, and choose the Identification Type

-SR ID: the SR ID on the temporary insurance card.

-Student ID: either the student ID provided during enrollment or the student ID on the confirmation letter.

![blog NYU banner [2023 updated] Insurance Waiver Guide for NYU](https://smcovered.com/wp-content/uploads/2021/04/blog-NYU_banner-768x433.jpg)

![IOWA banner [2022 Latest] Insurance Waiver Guide for IOWA](https://smcovered.com/wp-content/uploads/2021/08/IOWA-banner-768x433.jpg)

![UCSB bannerfeatured image [2023 updated] Insurance Waiver Guide for UCSB](https://smcovered.com/wp-content/uploads/2022/08/UCSB-bannerfeatured-image-768x431.jpeg)