OPT Insurance Guide: Cost of Ambulance in the United States

Introduction

As graduation approaches, students will soon enter the peak period of OPT application, and in the meantime, the student insurance they had during their time in school will expire as their student status changes. However, whether you are on OPT or in school, you need medical insurance to protect yourselves in the United States, otherwise, you may incur high medical bills and even violate the legal requirements for employees.

Table of Content

1. The Incident from our Insured OPT Student

1. The Incident from our Insured OPT Student

Recently, our customer service team received an urgent inquiry from an insured OPT student who had accidentally injured his ankle and was in excruciating pain. He called an ambulance at midnight and went to the emergency room. He was very worried about receiving expensive bills from the hospital and ambulance, so he consulted us about the insurance reimbursement.

But when he received the actual reimbursement bill a few weeks later, he suddenly realized that he had nothing to worry about. So, let’s take a look at what this student experienced over the past months:

- November 20th – He had a fractured right ankle due to accidental injury

- November 21st Midnight – He Called an ambulance and went to the emergency room due to unbearable pain.

- November 21st Morning – After coming out of the emergency room, he rested at home for a week and during that time, he searched online regarding emergency bill and realized that he might receive sky-high bills!

- November 23rd morning – He contacted our customer service and received the following:

“For students who enrolled in our Elite plan, he needs to pay a $150 copay for emergency room, but for the remaining of the bill, the insurance company covers 90% for in-network medical services after in-network discount. If an in-network provider is not available in the “Network Area” (50 mile radius), benefits will be paid for Covered Medical Expenses provided by an Out-of-Network Provider at the same level.

Note: Same rules apply for the ambulance service.

2. OPT Insurance Coverage for Ambulance in the United States

2. OPT Insurance Coverage for Ambulance in the United States

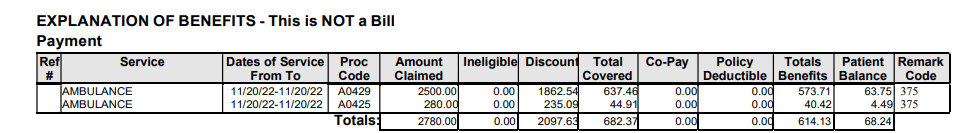

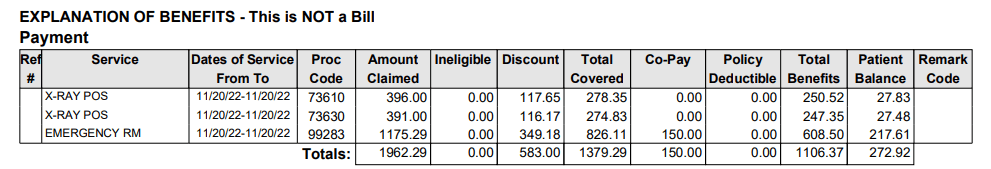

As expected, three weeks later, he received his claimed Explanation Of Benefit (EOB) in the account, indicating that the total cost of the ambulance was over $2,000, but was mainly covered by our Elite plan. As stated in the picture below, he was only charged for about $68!

In addition to his ambulance bill, his emergency room (ER) bill was also successfully reduced from nearly $2,000 to just over $200 (including a $150 ER Copay) thanks to our OPT insurance discount and claims, making his total medical bill of nearly $5,000 to just over $300!

3. Will I face unexpected medical bills if the ambulance takes me to an out-of-network hospital ?

3. Will I face unexpected medical bills if the ambulance takes me to an out-of-network hospital during a medical emergency?

In most emergency situations, there’s no opportunity to choose your hospital. After going through the scenarios above, you might be wondering about the implications if you find yourself in a hospital that is not within your insurance network. Does this mean you’ll have to deal with outrageously high medical bills?

In the past, if you ended up at an out-of-network hospital, you would be saddled with a bill that was only partially covered. However, there’s positive news on the horizon: as of January 2022, a new U.S. federal law known as the ‘No Surprise Act’ has been enacted. This means that even in cases where you are directed to an out-of-network hospital due to a medical emergency, your financial responsibility will be limited to what you would have paid if you had sought treatment at an in-network facility.

It’s worth noting that Student Medicover health insurance is fully compliant with the No Surprises Act and our team is here to assist you in managing any unexpected medical expenses that may arise.

4. Conclusion of OPT Insurance Benefits

4. Conclusion of OPT Insurance Benefits

Actually, thousands of OPT students live and work in the US every year, and they might encounter similar situations above. However, it is very important to know that Student Medicover provides free insurance planning and enrollment assistance for all OPT students. Whether you have already applied for an EAD card or not, our assistants will provide you with personalized service regarding everything you would like to know about OPT insurance.

Student Medicover OPT insurance can help you for all types of medical needs as well as provide the timeliest service. Click here to contact us immediately and let us continue to protect your safety and health during your OPT period here in the US!