Must Read for International Students | A detailed guide to dental insurance & dental discount plans in the US!

Introduction

Many international students find it difficult to see a dentist in the United States. We always receive emergent inquiries from students for immediate assistance, such as:

- Where can I find a dentist now?

- Is there a waiting period for dental treatment?

- Do I need to enroll in dental insurance separately?

- What is the difference between dental insurance and a Dental Discount Plan?

- Etc.

Among all above, the most frequently asked question is, “Does my medical insurance cover dental treatment?”, and here we would like to remind everyone that not all treatments are covered by medical insurance. Some of them such as dental treatment, vision insurance, etc., are not covered, as dental insurance is mostly a stand-alone plan and needs to be purchased separately.

Note: Even if it is included, it usually only covers dental insurance under the age of 19 (Pediatric Dental).

As a result, many students will have to pay for their own dental and ophthalmic treatment. To minimize exorbitant dental expenditures, we recommend that international students over the age of 19 purchase special dental insurance or a dental discount plan.

Navigation

1. What does dental insurance cover? What is not included?

1. What does dental insurance cover? What is not included?

There are four levels of dental insurance coverage.

Level 1: Preventive Dental Plan

- Oral Exams

- Routine Cleanings / Prophylaxis

- Periodontal Maintenance

- Fluoride Treatment / Topical Fluoride / Fluoride Varnish

- Full-Mouth X-Rays

A preventive dental plan is typically light and has the highest compensation ratio. Most dental insurance policies can reimburse more than 80%, if not 100%. Some have a claim limit and will be categorized as other levels based on the doctor’s diagnosis.

Level 2: Basic Dental Plan

- Dental Restoration

- Cavity

A basic dental plan covers mostly dental care treatments, and dental insurance companies usually reimburse up to 70% of the cost.

Level 3: Nursing Dental Plan

- Complex Oral Surgery

- Crown

- Bridge

- Denture

- Implant

A nursing dental plan consists primarily of large-scale dental operations, with a low reimbursement ratio (usually less than 50%) and relatively high claims. Before treatments, you need to check with your doctor to see if your dental insurance covers all.

Level 4: Corrective Dental Plan

Orthodontic Treatment

In most cases, the cost of orthodontic treatment is estimated independently. Most dental insurance policies will cover orthodontic treatments up to $2500, but there will be a lifetime maximum or a maximum number of times (usually one time).

Note: Dental insurance generally does not cover cosmetic dental items, such as:

- Teeth Whitening

- Porcelain Veneers

- Invisalign

2. Dental Insurance VS. Dental Discount Plan

2. Dental Insurance VS. Dental Discount Plan

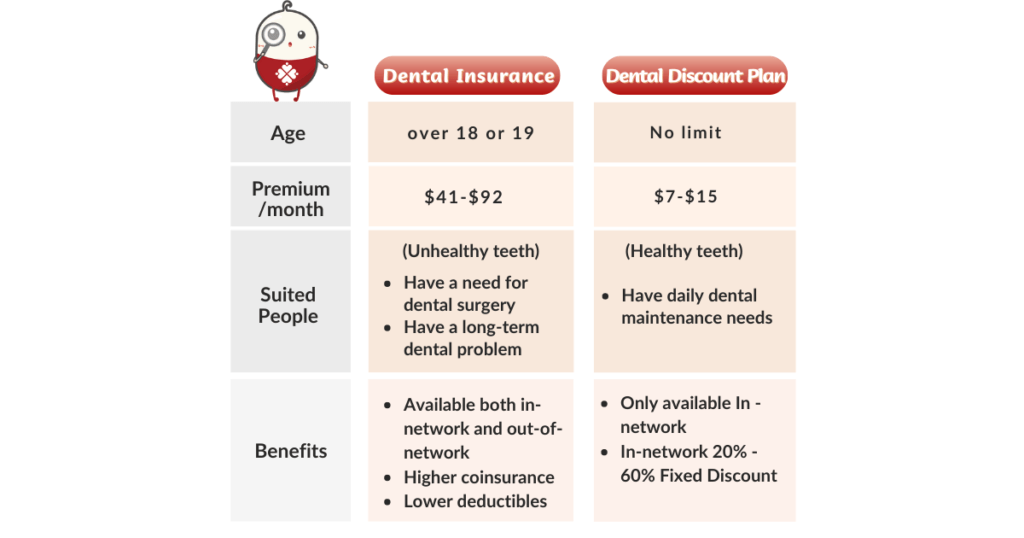

a. Which one to choose?

If you are already dealing with dental problems, we suggest that you get dental insurance to save money and time, as well as to avoid being unable to seek medical treatment when there is an urgent problem with your teeth.

If your teeth are in good condition at this moment, and you just have minimal needs, but you want to save money on daily cleaning, orthodontics, and dental beauty, the dental discount plan may be a better option.

b. Dental Insurance Plan and Dental Discount Plan provided by Student Medicover

Student Medicover provides both dental discount plans and dental insurance plans to accommodate a variety of needs. Insurance companies typically provide dental insurance policies, and members can benefit from cheaper costs and deductibles for a monthly fee.

While dental discount plans are not insurance, policyholders are given a discount card that allows them to save money on specified programs and services at partner organizations.

Different insurance providers define different forms of treatment differently. The coverage percentage for diagnosis or preventative treatment is normally between 80% and 100%, which means that some plans with 100% coverage can be paid for free 2-3 times each year.

3. Advantages of Dental Insurance

3. Advantages of Dental Insurance

a. Dental insurance can save you a lot of money on dental care.

Eg. Renaissance’s Max choice plan pays 100% for diagnostic or preventive treatment items, which means routine cleanings and check-ups are free.

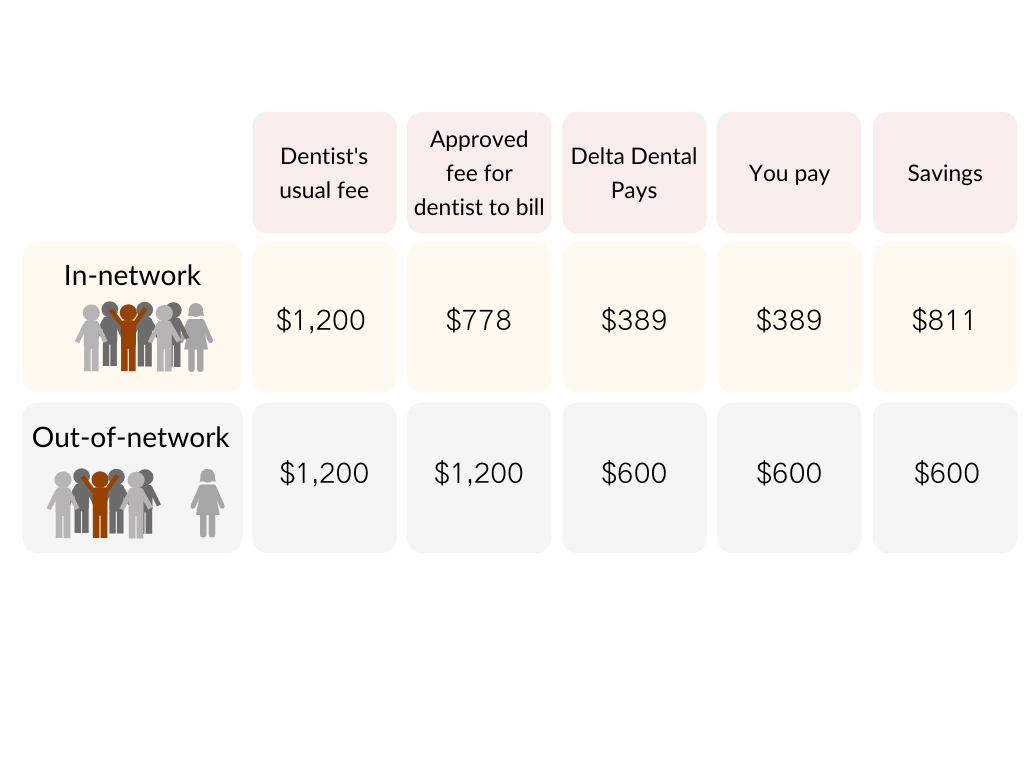

b. You could use an in-network dentist to keep out-of-pocket costs to a minimum.

Eg. Delta Dental

4. How to choose a dental plan

4. How to choose a dental plan

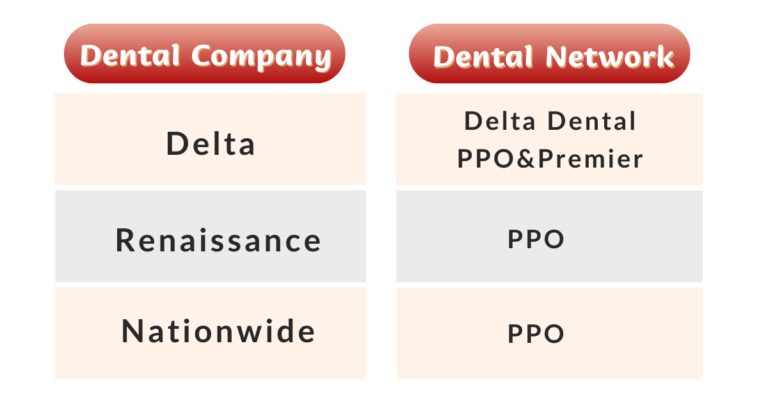

Student Medicover selects four of the most highly rated companies on the market to provide dental products.

- Dental insurance plans offered by Delta, Renaissance, and Nationwide

- The dental discount program is offered by Careington Company.

5. Frequently Asked Questions Before Buying Dental Insurance

5. Frequently Asked Questions Before Buying Dental Insurance

Q1: Is there a minimum period of time required?

Dental insurance and discounts are based on membership, with no time commitment required. Subscriptions are paid on a monthly basis, and the charge is automatically renewed.

Q2: How long will it take for the plan to take effect?

The effective dates are not immediate. If you enroll in a dental plan before the 20th of the month (including the 20th), the earliest effective date available is the 1st of the next month. The earliest available effective date for dental plans acquired after the 20th of the month is the 1st of the month after next.

Q3: How do I find out whether a plan has a waiting period?

Delta Dental and Renaissance both offer immediate plans for covered treatments. Please see the column on the homepage of each plan to check their waiting period respectively.

Q4: Can I enroll in a dental plan without SSN?

Yes, Student Medicover can help policyholders apply for a temporary ID, as long as students provide their personal information. For details, please consult our customer service team.

6. How to buy dental insurance or a dental discount plan

6. How to buy dental insurance or a dental discount plan

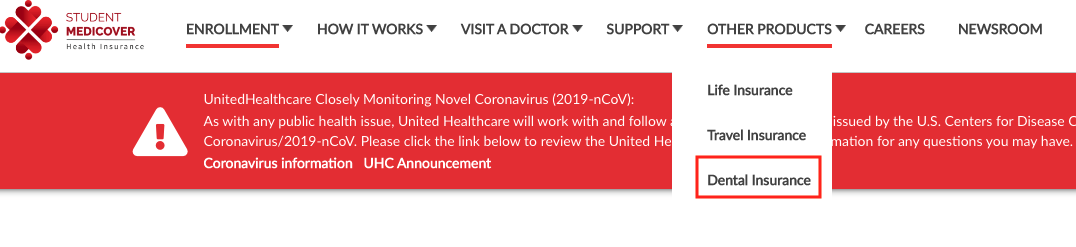

(1) Log onto the dental plan page

Select “Other Products” in the upper menu bar of SM Covered official website and click Dental Insurance to enter the dental plan page .

(2) View all dental plans

On the dental plan page, you may enter all your personal information and select the effective date to see all the eligible plans.

*If there is no product available in your location, please email us at sm@smcovered.com for consultation.

(3)Select your proper plan

Click Filter in the upper right corner to view plans from various providers and select the one that best meets your needs.

In addition, you can click View Details to check for plan details, and click Find Providers to locate dentists in the network to compare different plans comprehensively.

We hope that all international students can have healthy teeth, and stay away from toothache!

Contact Us

Finally, SM assistants hope every international student receives the best quality service and the most solid medical protection. If students have questions before or after purchasing, please feel free to email us at sm@smcovered.com for further help!